:Unsplash/Link Hoang

Aaron Sherwood

II

,2028,

“”,

,“”

,,,,

,,——,,

,“”,

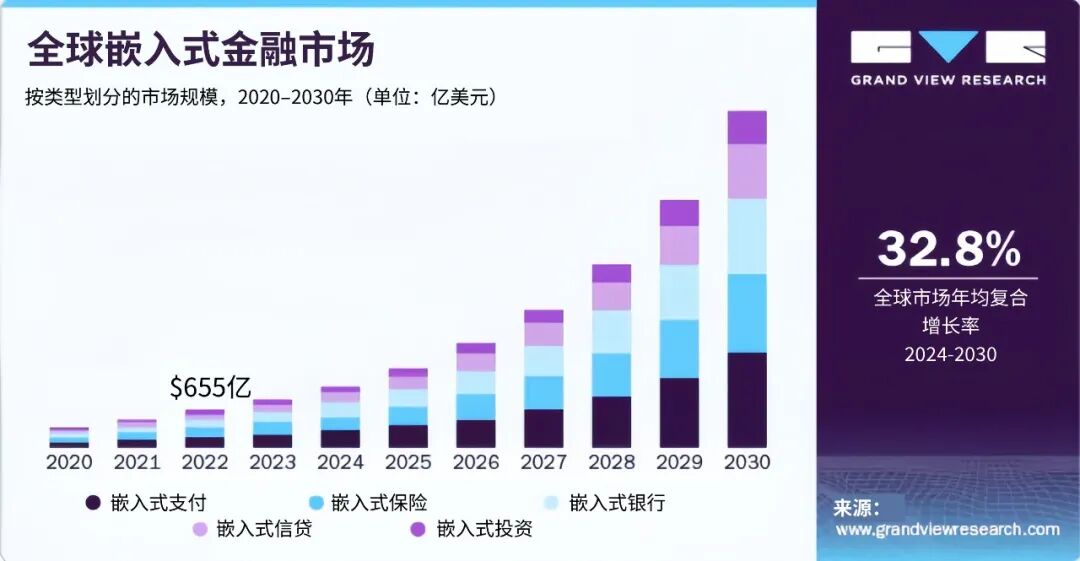

According to the Boston Consulting Group, total embedded insurance premiums written are projected to grow from $13 billion to over $70 billion by 2030. This isn’t incremental growth—it’s a transformative reshaping of the industry.

Image source: Grand View Research

How embedded insurance works in practice

Several companies, including well-known brands, are making their insurance products more accessible and integrating them seamlessly into users' purchasing journeys.

Airbnb's AirCover service automatically provides hosts with up to $3 million in liability and damage protection for each booking. This service is seamlessly integrated into the booking process, so there’s no need to register separately or purchase an additional policy.

Avios' Wanda is a travel protection service that travelers can seamlessly add at checkout when booking flights or hotels. The service is fully integrated into the booking process, allowing customers to easily manage it via the Wanda App—making protection an integral part of the travel experience, rather than an afterthought.

AppleCare is available when you purchase your iPhone, Mac, or iPad—either online or in a retail store. It’s an included device protection plan that covers accidental damage, repairs, and even, in select regions, theft or loss.

"At the end of the day, the question isn’t whether embedded insurance will grow—it’s whether it can address the industry’s underlying problems."

Why embedded insurance is gaining momentum

The rise of embedded insurance can be attributed to a fact that cannot be overlooked: we are living in an era where the "protection gap" is steadily widening. This so-called protection gap refers to the growing chasm between the coverage people currently have and the protection they actually need.

According to data from fintech venture firm Fintech Ventures, this gap doubled between 2000 and 2020, driven by urbanization, climate shocks, and a persistent lack of innovation. Today, millions of people find themselves either inadequately protected or forced to pay exorbitant premiums for policies they don’t fully understand. Most critically, traditional insurance is losing the very demographic it needs most—young people.

A 2023 study by LIMRA found that only 48% of Millennials and 40% of Gen Z have life insurance, with nearly half of them feeling their coverage is inadequate. Many young people say they avoid purchasing policies due to high costs, unclear terms, and a lack of trust. This isn’t just a sales challenge for the industry—it’s a generational crisis. If younger generations opt out altogether, the entire insurance model could unravel.

How to bridge the "protection gap"

Embedded insurance 2.0 may well be the industry’s best chance to turn things around—but relying solely on embedding isn’t nearly enough. The real key lies in trust. Ernst & Young estimates that by 2028, more than 30% of insurance transactions will be conducted through embedded channels. However, if consumers don’t trust the products they’re buying, even this high penetration rate will mean nothing.

Real-time, data-driven personalized services are set to become a game-changer, especially for the younger generation, who increasingly value personalization and instant gratification. Higher-quality data can lead to tailored insurance solutions that better meet individual needs.

Accenture's research shows that six out of ten consumers would be willing to share significant amounts of their personal data—if it means receiving fairer pricing and more personalized, life-enhancing benefits in return.

However, trust doesn’t rely solely on data—it depends even more on how that data is used. Digital wallets can help bridge gaps in insurance coverage. For instance, platforms like Rehuman leverage generative AI to deliver insurance information to people in a clear, easy-to-understand manner, showing policyholders exactly what their coverage includes—and where potential gaps may exist.

However, the real advantage lies in the fact that the booming growth of embedded insurance stems from collaboration, not isolation. Traditional insurers bring expertise in underwriting, while insurtech drives technological advancements. Meanwhile, consumer brands offer a level of everyday trust and data engagement that traditional insurers simply can’t match.

Organically integrating these three elements will not only broaden your reach but also unlock deeper insights, enabling the creation of products that resonate more closely with everyday life—and seamlessly integrate into people's routines.

High-risk protection

EY predicts that embedded finance will soon account for nearly one-third of the entire insurance market. However, this growth will be meaningless unless the experience delivers genuine value.

Ultimately, the question isn’t whether embedded insurance will grow—it’s whether it can address the industry’s deep-rooted problems. Can it close the coverage gap? Can it help restore a more human touch to insurance? Most importantly, can it win back the generation that the industry had previously overlooked?

Today, the situation is crystal clear: either reinvent yourself—or risk being left behind by the times. A new wave of technology has already surged into the palms of our hands. The future of the insurance industry will be shaped by brands that embrace transparency, collaborate with innovators, responsibly leverage data, and prioritize "people" over profit.

The above content represents the author's personal views only.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment at the end of the post or on our official account if you’d like to republish.

Editor: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Channels, Douyin, and Xiaohongshu!

"World Economic Forum"