Social and economic instability driven by geopolitical tensions could persist.

Image source:Unsplash/Big Dodzy

Simon Torkington

Senior Writer for the Forum Agenda

A new survey reveals that geopolitical issues have surpassed inflation as the top risk factor for central banks and sovereign wealth funds worldwide.

The survey found that 53% of central banks plan to increase their reserves, while 52% intend to diversify their equity holdings.

The World Economic Forum's "2024 Global Risks Report" paints a pessimistic picture of the future global landscape, with 60% of respondents believing that the next decade will be marked by intense volatility.

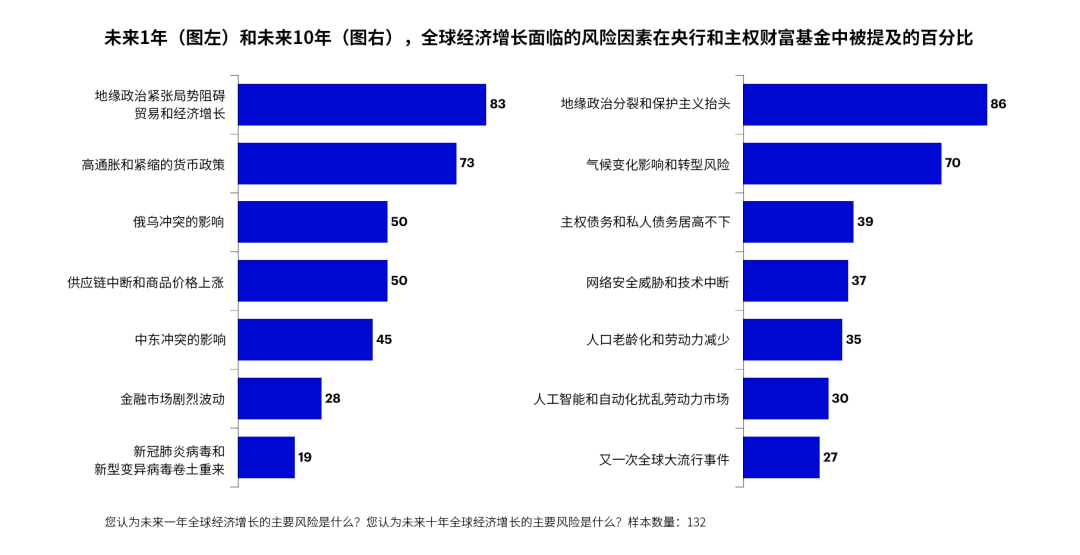

This year, with over 4 billion voters worldwide, geopolitical issues have become the top concern for central banks and sovereign wealth funds across nations.A recent survey by Invesco Asset Management reveals that deepening polarization and a fragmented political landscape have overtaken inflation as the primary risk factor for many institutions. The trends outlined in the "2024 Global Sovereign Asset Management Study" suggest that, amid today’s increasingly complex and volatile global geopolitical environment, central banks and sovereign wealth funds across the globe will face even greater challenges.Central banks across the globe have identified geopolitical tensions as the primary threat to economic growth.

Image source:Invesco's "Global Sovereign Asset Management Study"

83% of respondents believe geopolitical tensions are the primary risk to global economic growth over the next year, surpassing concerns about high inflation and tight monetary policies (73%). Looking ahead to the next decade, 86% of respondents see rising geopolitical divisions and protectionism as the most serious long-term threats.The survey reveals that ongoing conflicts in Ukraine and the Middle East—along with heightened tensions between major powers like China and the U.S., as well as the uncertainty surrounding the outcomes of numerous elections in 2024—are driving increased attention to geopolitical risks.How are financial institutions addressing these risks?To address these risks and challenges, central banks around the world are strengthening and diversifying their reserve portfolios. More than half (53%) of central banks plan to increase the size of their reserves over the next two years, while 52% intend to further diversify the structure of their asset holdings. This strategy aims to build a robust buffer against potential financial and economic shocks, ensuring that sufficient resources are available for intervention during times of market turmoil.Jing Shun's research also highlights that central banks and sovereign wealth funds are increasingly shifting their focus toward gold and emerging markets as part of diversification strategies. The potential "weaponization" of central bank reserves makes gold more appealing to 56% of respondents, while allocations to emerging markets are expected to grow significantly over the next five years.As sovereign investors adapt to the evolving landscape, their strategies reflect a delicate balance—navigating today’s geopolitical risks while striving to secure long-term stability and growth in an increasingly multipolar world.There is no quick fix for tackling global uncertainty.

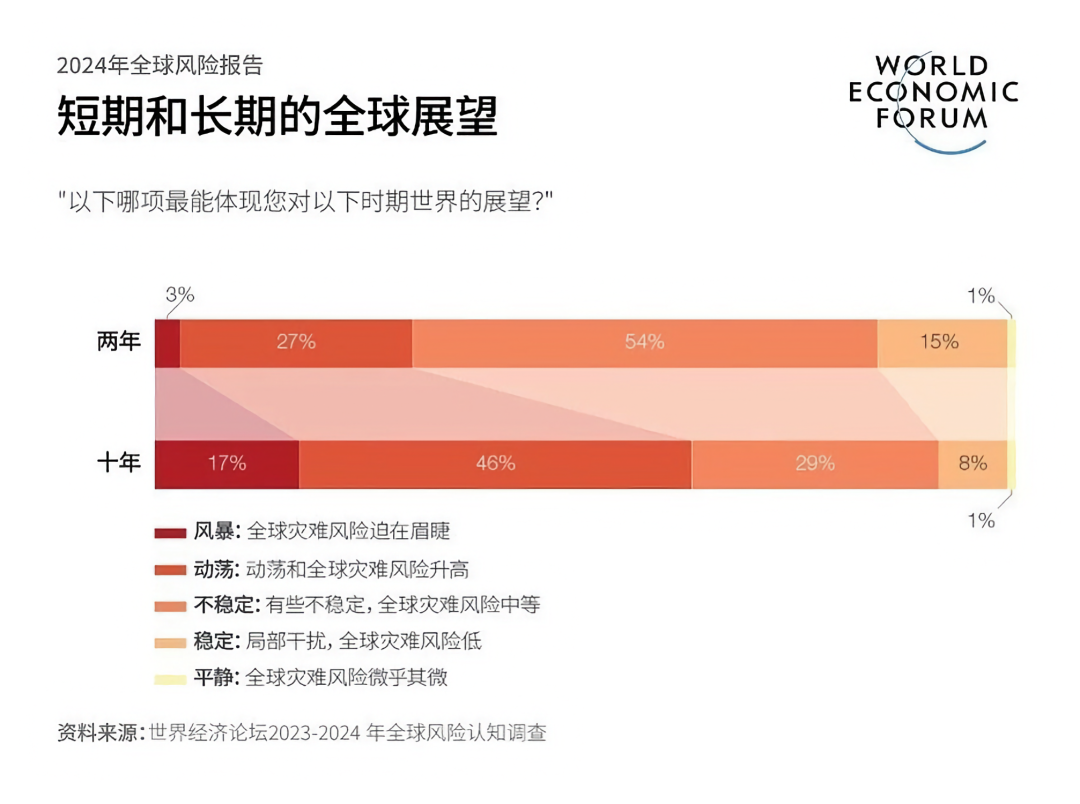

Social and economic instability driven by geopolitical tensions may persist.The World Economic Forum's "Global Risks Report 2024" highlights that, in this year's global risk perception survey, two-thirds of respondents believe "a multipolar order will dominate over the next decade, with middle- and major powers competing with one another even as they collaborate to shape and enforce existing rules and norms."The "2024 Global Risks Report" largely adopts a pessimistic outlook on the prospects for global stability.

Image source:World Economic Forum

The survey found that 54% of respondents believe the next two years will bring some level of global instability along with moderate catastrophic risks, while another 30% predict even greater turmoil in the global landscape during the same period. Looking ahead to the next decade, the outlook becomes significantly more pessimistic, with nearly two-thirds of respondents anticipating geopolitical storms or highly volatile conditions.Restoring global stabilityIn addition to highlighting geopolitical tensions and the polarization of global political discourse, the *Global Risk Report* also outlines a range of actionable strategies—applicable from national to individual levels—that can help stabilize the world order.Large-scale cross-border cooperation is crucial; otherwise, it could lead to armed conflicts between nations or other situations that threaten human security and prosperity. Moreover, both the public and private sectors will play vital roles, as localized investment and regulatory measures can help mitigate predictable risks.Facing global challenges, individual actions may seem insignificant. However, the report highlights that when these small steps come together, they can significantly reduce global risks.Over the next decade, the world will undergo unprecedented changes, testing our ability to adapt. The future holds multiple possibilities, but the efforts we’re making today to address global risks could pave the way for a more positive outcome.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Translated by: Sun Qian | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"