A geologist stands outside a cobalt mine in Idaho, USA.

Image source:Reuters / Carlos Barria

Dimitri Zabelin

Geopolitical Strategist at Pantheon Insights

Daan-Max von Dongen

Assistant and PhD at Oxford University

Geopolitical competition is driving the clean energy transition, as nations vie with one another in terms of legislation and investment.

However, the growing demand for critical minerals coupled with their limited supply could hinder this process.

Facilitating collaboration through third-party organizations is key to ensuring that the transition becomes a global collective effort.

The global race for energy transition has already spurred significant investment in the infrastructure sector, with the United States, the European Union, and China leading the charge. In the U.S., the landmark Inflation Reduction Act (IRA) allocates $369 billion toward clean energy development, focusing particularly on scaling up domestic manufacturing of critical technologies like electric vehicles and renewable energy components. By enacting this legislation, the U.S. aims not only to cut emissions but also to reclaim its position as a global leader in green technology production. This initiative mirrors the EU’s Fit for 55 plan, which is part of the bloc’s broader Green Deal. The EU’s strategy targets climate neutrality by 2050, with key investments directed toward hydrogen, offshore wind power, and modernizing its electricity grids.China is already the world’s largest producer of solar panels and is leveraging its dominant position in the clean energy technology supply chain to further solidify its global leadership. In 2022, China accounted for 80% of the world’s solar panel production and continues to lead the global battery market. Meanwhile, resource-rich countries like Australia and Canada are capitalizing on their abundant mineral reserves. Australia, which produces more than half of the world’s lithium, is strategically positioning itself as a key player in the energy transition by fully benefiting from the surging global demand for critical materials.Transitioning to green infrastructure has become an accelerating trend, as countries recognize that energy security, technological leadership, and climate action are inextricably linked. However, geopolitical competition has triggered supply-chain bottlenecks for critical minerals, raising concerns that this race could inadvertently slow down the very progress it seeks to achieve.Alongside the energy transition, often referred to as "green inflation," comes a sharp surge in the prices of raw materials and renewable technologies, sparking widespread concern. Yet, advancements in technology and regulatory frameworks are also beginning to ease these inflationary pressures. Over the past decade, thanks to improved production efficiency and economies of scale, the costs of solar and wind energy have dropped by 85% and 55%, respectively.Additionally, emerging technologies such as carbon capture and storage (CCS) and small modular reactors (SMRs) offer the potential for low-cost decarbonization. For instance, the International Atomic Energy Agency (IAEA) predicts that, with sufficient policy support, SMRs could deliver scalable, affordable, low-carbon energy by the 2030s.In terms of regulation, initiatives like the EU's Carbon Border Adjustment Mechanism (CBAM) aim to prevent carbon leakage by imposing tariffs on carbon-intensive imported goods, ensuring a more equitable sharing of decarbonization costs. This regulation not only creates a level playing field for European companies but also encourages green production practices worldwide, helping to foster sustainable growth while mitigating the risks of "green inflation."In terms of resource demand, the International Monetary Fund (IMF) estimates that the global energy transition will have the most significant impact on the demand for copper, nickel, cobalt, and lithium. Forecasts regarding anticipated demand—and the resulting price implications—depend on the time horizon and the specific scenario being considered. Notably, achieving net-zero emissions by 2040 versus 2050 is expected to yield dramatically different effects on the prices of these critical transition metals, given the wide range of projections involved. Meanwhile, the World Bank predicts that by 2040, lithium demand could surge sevenfold compared to 2020 levels. The IMF, meanwhile, projects that under a net-zero emissions scenario, lithium consumption could soar by as much as 25 times its 2020 level by 2050.The International Energy Agency has also outlined a range of possible future scenarios. In its Sustainable Development Scenario (SDS), demand will far outpace supply, with lithium demand projected to be 51 times higher by 2040 than it is today. Applying the International Energy Agency’s Sustainable Development Scenario to other transition metals like cobalt, nickel, and copper similarly reveals a sharp surge in demand:- By 2040, the demand for cobalt will be 21 times higher than it is today.

- By 2040, the demand for nickel will be 9.7 times higher than it is today.

- By 2040, the demand for copper will be 6.2 times higher than it is today.

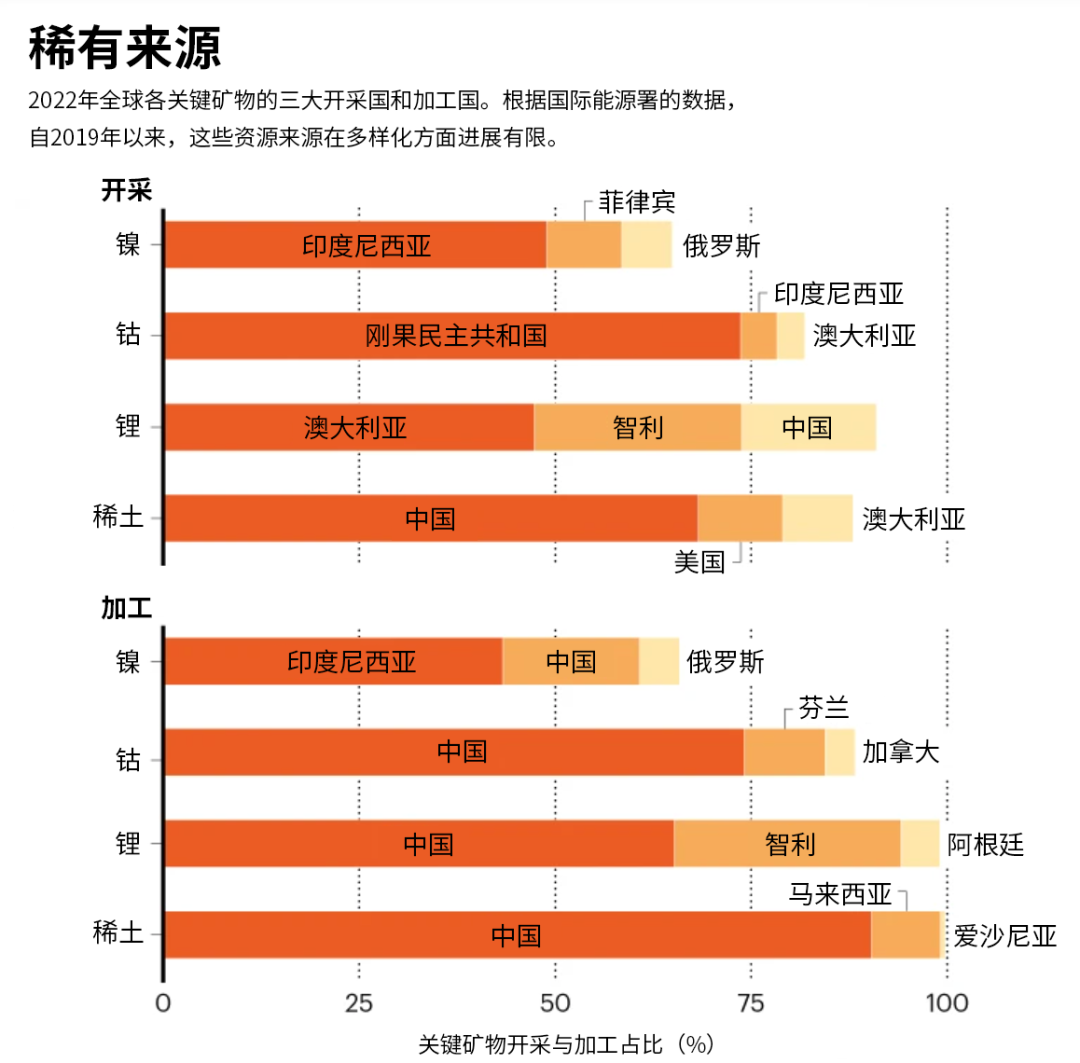

Compared to traditional technologies, new green technologies often require significantly more physical materials during the development phase to achieve the same level of output. For instance, battery electric vehicles (BEVs) typically weigh 15% to 20% more than their internal combustion engine (ICE) counterparts, making them a key driver of material demand in the coming decades. By 2030, electric vehicles are expected to account for between 35% and 68% of new car sales, with most forecasts projecting a range of 40% to 50%. This means that annual EV sales could reach anywhere from 25 million to 40 million units by 2030—compared to approximately 7 million units sold annually in 2022. Meanwhile, according to IMF projections, under a scenario aiming for net-zero emissions by 2050, global production of critical metals like graphite, cobalt, vanadium, and nickel will fall short of demand, potentially leaving gaps exceeding two-thirds of total requirements. Even metals such as copper, lithium, and platinum face significant shortages, ranging from 30% to 40%, which could jeopardize their ability to meet the growing demands of the clean energy transition.Additionally, the concentrated distribution of critical minerals and metals needed for the energy transition will become a hot topic in the supply chain. The data in the chart below is based on 2022 production levels, expressed as percentages of the global total.Critical minerals are concentrated in just a few key countries.

Image source:International Energy Agency

The concentration of critical mineral sources in just a few countries has created vulnerabilities in the supply chain. Geopolitical tensions could lead to supply disruptions or export restrictions, potentially jeopardizing global energy goals. Moreover, geopolitical competition may trigger supply chain fractures, undermining cross-regional cooperation—especially when nations prioritize self-sufficiency over collaboration. Such rivalry could delay collective efforts to meet climate targets, heightening risks of supply shortages and regulatory mismatches.In this context, third-party organizations like the World Economic Forum play a critical role in bridging divides by fostering dialogue, reshaping policy frameworks, and driving coordinated action. Without such intermediary institutions, the transition could easily devolve into a zero-sum game rather than a global effort grounded in collaboration and shared purpose. As the energy landscape undergoes transformation, promoting cooperation has become essential—not only to manage competition but also to safeguard sustainable development worldwide.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Translated by: Sun Qian | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Channels, Douyin, and Xiaohongshu!

"World Economic Forum"