Businesses must enhance their climate resilience to withstand increasingly frequent climate-related disasters.

Image source: Unsplash/Hoang Nguyen

Chen Deliang

Professor, Department of Earth System Science, Tsinghua University

Gill Einhorn

Global Head of Innovation and Transformation at the World Economic Forum

The collapse of Earth's systems is increasingly undermining corporate profit levels, fixed assets, supply chains, and societies across nations.

If companies fail to proactively address climate risks, they could face annual revenue losses of up to 7% by 2035.

China is facing risks posed by climate disasters, yet it is also taking the lead in investing and actively implementing a forward-thinking resilience strategy.

Relevant projections indicate that insurance claims related to climate-related disasters could reach as high as $145 billion in 2025, a 6% increase from 2024. This growing trend underscores the mounting economic toll that climate change is inflicting on the global economy, highlighting the urgent need for all stakeholders to step up their efforts.

The Chinese-language report, "Urgent Action Needed: Strengthening Corporate Resilience to Climate Risks," jointly released by the World Economic Forum and Accenture, provides a comprehensive assessment of the risks climate disasters pose to businesses—and offers actionable strategies for boards of directors, investors, corporate executives, and operations leaders to enhance resilience.

The report quantitatively analyzes the risks posed by seven climate hazards—extreme heat, wildfires, drought, water scarcity, tropical cyclones, coastal flooding, and river flooding—to corporate fixed assets across 20 global industries.

The report assesses supply chain risks across five key socio-economic systems: agriculture, the built environment, technology, health and well-being, and financial services.

Among the countries most vulnerable to climate risks, China is particularly susceptible to disasters such as floods, tropical cyclones, and extreme heatwaves.

"Public investment is crucial, but to address risks at the corporate level, resilience must also be integrated into business models."

For businesses, these climate events not only pose environmental risks but also threaten to severely disrupt their growth, operational stability, and long-term competitiveness.

In 2023, climate-related disasters caused economic losses of 308 billion yuan (roughly equivalent to $42 billion) in China.

The report focuses on the seven most severe climate disasters.

Image source: The report "Time is Running Out: Strengthening Corporate Resilience to Weather Climate Disasters"

Companies investing in climate adaptation, resilience, and decarbonization have already reaped tangible returns. Data from the Carbon Disclosure Project reveals that for every dollar invested in climate adaptation and resilience, businesses can avoid up to $19 in potential financial losses.

Resilient investing can fuel innovation and value creation—topics that lie at the heart of the World Economic Forum’s 2025 Annual Meeting of the New Champions.

Climate disasters are impacting corporate profit levels.

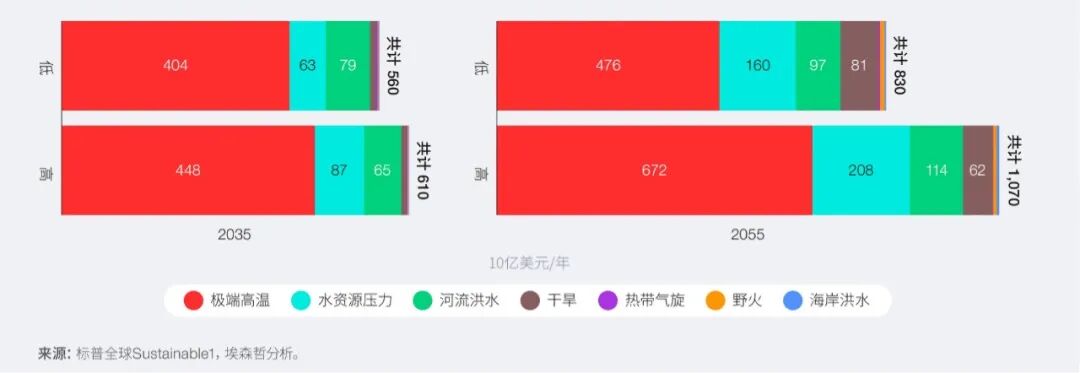

According to projections based on different emission scenarios, climate-related disasters could cause annual losses of between $560 billion and $610 billion to the fixed assets of global publicly listed companies by 2035.

By 2055, these losses could climb to $1.1 trillion annually, representing an average revenue decline of 6.6% to 7.3% per company by 2035.

Meanwhile, in sectors most vulnerable to such impacts—such as utilities, telecommunications, and tourism—the losses could exceed 20%, with extreme heat emerging as the primary factor driving declines in corporate profitability.

Under both low-emission and high-emission scenarios, the total annual losses to listed companies' fixed assets caused by various climate-related disasters amount to (USD 1 billion per year, 2035–2055).

Image source: The report "Time is Running Out: Strengthening Corporate Resilience to Weather Climate Disasters"

These industries not only face threats to their physical infrastructure, but disruptions in the supply chain, declining production efficiency, shifting consumer behavior, and resource shortages all indicate that climate risks could eventually impact every single link in the value chain.

In addition to the risks mentioned above, scientists also warn that Earth's systems are on the verge of crossing irreversible tipping points—such as the collapse of polar ice sheets and shifts in ocean currents—which could have far-reaching consequences for ecosystems of all kinds and the global economy.

This poses a critical question for business leaders: How can companies adapt, grow, and lead in the face of the new climate reality?

China's investment lays a solid foundation for climate action.

China has made significant progress in strengthening its public infrastructure system and improving climate risk management.

Through strategic investments, China has developed evidence-based tools and forward-looking capabilities that enable it to effectively assess and respond to climate-related disasters.

From 2019 to 2023, the national funding for disaster prevention and emergency response increased by an average of 8.85% each year. In 2024 alone, the Chinese government allocated 334 billion yuan (equivalent to $46 billion) to enhance disaster management capabilities.

China also operates the world's largest meteorological observation system, which includes 9 Fengyun weather satellites, more than 500 weather radars, and over 70,000 ground-based weather stations.

These infrastructures, combined with advanced weather forecasting models and AI-driven prediction technologies, have enabled China to develop a cutting-edge early warning system capable of delivering rapid and highly accurate responses to extreme weather events.

Public investment is crucial, but to address risks at the corporate level, resilience must also be integrated into business models. Climate disasters not only threaten buildings and infrastructure—they also significantly impact procurement, manufacturing, logistics, and consumer demand.

To survive and thrive, every business must identify its own risk vulnerabilities and proactively implement climate adaptation and resilience measures.

"Climate resilience is not a sunk cost—but rather a crucial lever for driving long-term value creation and business growth in an increasingly unpredictable global landscape."

Action Plan to Enhance Corporate Resilience

To remain competitive and resilient in a world where temperatures rise by 1.5 degrees Celsius, businesses must adopt forward-thinking, integrated strategies. The following five actionable steps can provide companies with a viable roadmap:

1. Aligning resilience with net-zero goals

Climate resilience and decarbonization efforts must advance hand in hand.

Integrate climate risks into core business decisions and strengthen accountability across the entire leadership team.

All capital planning and investment decisions must consider resilience factors.

Ensure that climate resilience and adaptation efforts encompass every level of the organization and all partners across the ecosystem.

2. Conduct a comprehensive climate risk assessment

Businesses need a clear understanding of the climate risks they face, including identifying vulnerabilities across their entire value chain—from raw materials to the delivery of the final product.

Conduct stress tests on critical facilities using scenarios aligned with those of the UN Intergovernmental Panel on Climate Change, combined with local disaster data.

Empower the board of directors with the responsibility of risk oversight, ensuring the implementation of systematic governance.

3. Investing in building resilient infrastructure

Upgrade assets to withstand future extreme climate events, including floods, heatwaves, and storms.

Examples include installing agricultural water-saving systems, upgrading industrial cooling systems, strengthening energy infrastructure, and enhancing operational stability.

4. Harnessing the Power of Scientific and Technological Cooperation

Investing enhances capabilities, enabling real-time monitoring, understanding, prediction, and action against climate threats.

Enhance system agility by leveraging technologies such as digital twins, AI-driven forecasting, and satellite monitoring.

Collaborate with scientific institutions to optimize local climate impact data, enhancing strategic foresight and operational decision-making capabilities.

5. Foster collaboration across the entire value chain

Companies should collaborate with suppliers, governments, non-governmental organizations, and local communities to jointly develop early warning systems and share innovative solutions.

This helps strengthen business continuity and fosters collaborative, friendly relationships among stakeholders.

Resilience is the new competitive edge.

Today, companies that lead in resilience will be well-prepared to better meet future regulatory expectations, investor scrutiny, and customer demands.

Resilient businesses are better equipped to absorb shocks when faced with external disruptions, enabling them to adapt to change sustainably and drive business growth.

Indeed, climate resilience is not a sunk cost—it is, in fact, a critical lever for driving long-term value creation and business growth in an increasingly unpredictable global landscape.

Now is the perfect time to take action—let’s not only prepare for what’s ahead, but also pave the way for the future.

Businesses have a unique opportunity and responsibility to lead adaptive actions, playing a pivotal role in shaping cross-border investment decisions, driving market innovation, supporting relevant policies, and enhancing long-term resilience.

If companies act decisively now and collaborate with all parties in the supply chain, they can not only safeguard their assets and reputation but also pave the way for a new era of sustainable growth.

The above content represents the author's personal views only.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments. For reprints, please leave a message at the end of the article or on our official WeChat account.

Editor: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"