Global species are disappearing at a rate 1,000 times faster than in history.

Image source:Unsplash/Juan Camilo Guarin P

Luo Yan

Director of the Urban Energy Internet Research Center at the Shanghai Institute of Electric Power, State Grid

Researcher, Nature and ESG Program, World Economic Forum

Wang Yao

Dean of the International Institute of Green Finance, Central University of Finance and Economics

Global species are disappearing at a rate 1,000 times faster than in history—protecting biodiversity is now more urgent than ever.

ESG is the concept and practice of integrating Environmental, Social, and Governance factors into corporate investment decisions and business operations.

For the capital market, only when funds flow into areas that genuinely contribute to nature conservation can we achieve the dual goals of economic development and ecological protection.

Global species are disappearing at a rate faster thanHistoryQuickDisappearing at 1000x the speedThis means that,The natural environment we depend on is changing—everything from the morning birdsong to the food on our tables could be affected.

Facing such a crisis, focusing solely on climate issues is no longer enough—we also need to protect biodiversity, andESG (Environmental, Social, and Governance)PhilosophyThat's exactly the key. Simply put,ESG is like a company’s "health checkup," and biodiversity is an indispensable indicator within it.

According to statistics, as ofBy 2030, the global financial need for biodiversity conservation is estimated to range between $722 billion and $967 billion.For the capital market, achieving the dual goals of economic development and ecological conservation requires that funds flow into areas that genuinely contribute to protecting nature.

In China,The ESG concept is gradually being put into practice.

In China,The ESG concept is gradually taking root and beginning to integrate into everyday life:

1. Policy Implementation: ESGEnterSystemFramework

FromFrom the "Dual Carbon" goals to the establishment of green finance reform pilot zones, a series of policies are driving the integration of ESG principles into the national governance system, fostering a top-down approach.Consensus Transmission Mechanism

2. ConsumersShift in consciousness: Over 70% of people are willing to pay for environmental protection.

"2023 China Consumer Trends Report"Shows,73.8% of consumers in their daily livesMore inclined toChoosing eco-friendly products or brands, the growing public awareness of environmental protection is reshaping market demand.

3. BanksIndustry:Actively participateBiodiversity Conservation

In 2021, the China Banking Association released the "Joint Statement by Banking Financial Institutions Supporting Biodiversity Conservation," focusing onStrengthen biodiversity conservationPropose7 financial support measures.

Challenges Facing Biodiversity InvestmentsTripleChallenge

Despite the conceptGradually being accepted, biodiversity investment still faces three major challenges:

1. NumbersAccording toInsufficiency, Information DisclosureStandardInconsistent

Currently, the development of biodiversity-related data platforms is still in its early stages. Institutions generally face the issue of insufficient data integrity, but an even more significant challenge lies in the low level of data integration.

For example, a mangrove forest not only helps reduce damage caused by typhoons but also provides vital habitat for marine life. Yet, these ecological benefits often lack systematic documentation—either scattered across scientific research materials or entirely uncollected altogether.

Even more complex is the fact that data standards used by businesses and environmental agencies are inconsistent, making it difficult for them to share and understand each other's information. Moreover, significant differences exist between financial institutions and companies regarding the standards for biodiversity-related disclosures, further undermining the comparability of the data.

As Zhang Zhengwei (Special Advisor to the Chair of the International Sustainability Standards Board) stated in2025During the World Economic Forum's "China Climate and Nature Action Day," it was pointed outSaid: "Integrating biodiversity into a sustainability reporting framework that businesses can easily understand is a critical challenge companies must address.”

2. Pricing and valuation lack standardized methods and tools.

In biodiversity investing, there are two prominent quantitative challenges.

On the one hand,The lack of fundamental methods and tools for identifying and quantifying ecological risks leads to lower efficiency in investment pricing. As Qi Jiuhong, Director and Assistant General Manager of the Beijing Green Exchange, noted2025Speaking at the World Economic Forum's "China Climate and Nature Action Day" event, he stated, "The biggest current constraints are how to effectively manage biodiversity issues through quantitative approaches and how to create incentives—such as pricing mechanisms—to ensure there’s someone willing to pay for these efforts. In the realm of biodiversity, we could draw inspiration from establishing mechanisms similar to carbon markets."

On the other hand, project screening and evaluationLacking clear standards,Enable financial institutionsDifficult toEvaluate a projectWhether it truly delivers environmental benefits remains uncertain. The lack of supporting data makes it difficult for investors to confidently assess the project's effectiveness, thereby dampening their willingness to invest.

3. The revenue cycle is long, and returns are uncertain.

Biodiversity investments often yield high social benefits but deliver slow economic returns.

For businesses, ecological conservation projects offer low returns and have a long payback period, making it difficult for their value to be directly reflected in market prices.

Bai Yunwen (Vice President of the Beijing Institute for Green Finance and Sustainable Development) pointed out at the forum:"Finance is gradually moving toward quantifying ecological benefits, and companies that make greater efforts in sustainable transformation will also gain more support from green credit initiatives."

For financial institutions, existing business models and financial tools are still underdeveloped, lacking mechanisms to effectively translate environmental benefits into commercial value. This makes it challenging for financial institutions to accurately assess the long-term potential of ecological projects, while also hindering the flow of capital into nature conservation efforts.

Seeking a Breakthrough: China Is Building a Biodiversity-Friendly Financial System

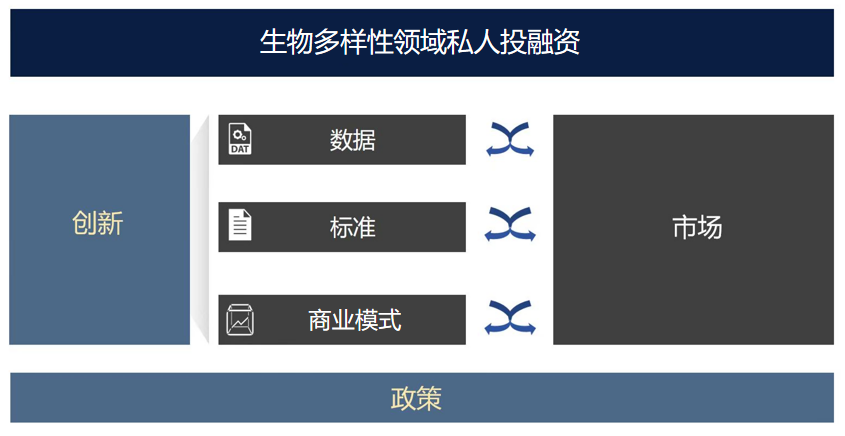

Currently, China's financial institutions are facing a significant opportunity: to build a financial system that supports biodiversity conservation by innovating in data, standards, and business models.

1. Using satellites and AIEnhancing Ecological Data Capabilities

The government and financial institutions can achieve ecological information sharing, and financial institutions can also establish their ownESGData platform.

These platformsIt can integrate professional tools such as biodiversity indices and ecological footprint calculations,And combined withMulti-source environmental data—including satellite remote sensing, drone aerial photography, ground-based sensing, and meteorological and hydrological observations—provide critical data support for investment decision-making and risk assessment.

For example, WeBank has partnered with the Public Environmental Research Center, utilizing satellite remote sensing.Monitoring forest coverage, combined withAIForecastProjectThe impact of development on the ecosystem,BuildingESGEvaluation System

2. Pilot program"Ecosystem Value and Risks"Tag”

In sustainable finance assessment tools, two innovations need to be achieved.

One is the pilot program based on ecosystem accounting."Nature-"Pricing" evaluation model. In the future, a box of tea might be labeled with "Ecological Value: XX yuan," helping consumers understand its ecological contribution.

Second, we will refine the risk management tools matrix to enable precise quantification of biodiversity risks. For instance, leveraging the biodiversity risk database developed by the International Institute of Green Finance at the Central University of Finance and Economics, E Fund Management has createdMethodology for Biodiversity Risk AssessmentForAsset management productsMarked it"Eco-Risk Label."

3. Drive financial product innovation and expand financing channels.

Innovation in financial products is key to driving the development of sustainable business models.

To establishThe collaborative mechanism among "government, enterprises, and financial institutions" can be strengthened by issuing structured biodiversity bonds or developing a diversified portfolio of eco-friendly financial products. For instance, State Grid Shanghai Electric Power Company has launched the "Electricity-Carbon Benefit Corporate Loan," leveraging grid data to provide green assessments for upstream suppliers in the supply chain, thereby helping small and micro-enterprises secure larger loan amounts at lower interest rates.

Additionally, we can draw on the development model of carbon markets to promote ecological compensation trading mechanisms. In the future,Maybe yesAppearing"Eco-Credit"Concept,EnableBusinesses can offset the negative impacts of commercial activities on biodiversity.

Looking ahead: Everyone is part of the ecosystem.

Protecting biodiversity isn’t just the responsibility of governments or corporations—it’s an issue closely tied to everyone’s daily life. It’s not some distant policy goal, but rather the foundation that shapes the water we drink, the air we breathe, and the safety of our food.

If everyone and every business can prioritize nature in their daily actions and support eco-friendly products and services, together we can collectively advance the cause of environmental conservation.

In the future, a trueA society that "votes for nature" will help drive the financial system to more accurately identify and measure ecological value. China's sustainable economic development may very well lie within these green transformations.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment at the end of the article or on our official account if you’d like to republish.

Editor: Wan Ruxin

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"