,

:Unsplash/Claudio Schwarz

Emma Charlton

?

:

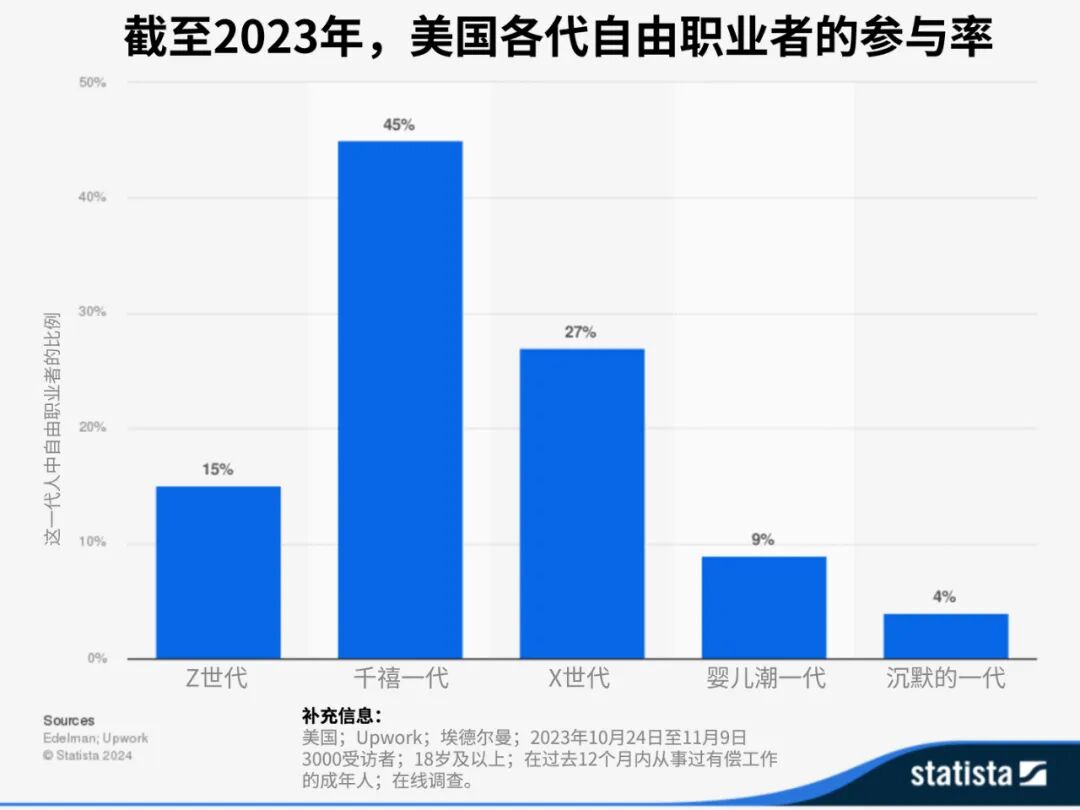

There are distinct generational patterns among gig workers: a 2023 survey of U.S. freelancers revealed that 45% of Millennials work as freelancers, compared to just 15% of Gen Z and a mere 9% of Baby Boomers (born between 1946 and 1964).Nearly half of millennial workers in the U.S. are freelancers.

:Statista

What financial considerations should gig workers keep in mind?Gig workers face unique financial challenges, requiring careful management of income, expenses, and tax obligations.These workers must carefully track all of their income and accurately report it on their tax returns.In the United States, gig workers are also required to pay self-employment taxes, which cover both the employer’s and employee’s portions of Social Security and Medicare contributions—totaling 15.3% of their net income.To offset these costs, gig workers can take advantage of various expense deductions, including those related to car maintenance, gasoline, insurance, and even a home office—if applicable.Developing a suitable budget is therefore crucial, as gig workers need to set aside funds for taxes, personal expenses, and potential income fluctuations. It’s recommended that U.S. gig workers allocate 20–25% of their earnings toward federal taxes and 5% for state taxes, helping them avoid being caught off guard by unexpected tax bills.The Impact of the Gig Economy on EmployersThe rise of the gig economy has dramatically transformed how employers manage their workforce and produce output.In a world where talent is scarce, companies are increasingly turning to freelancers, gig workers, and independent contractors to build a more flexible and agile workforce.This shift enables employers to quickly adjust workforce size and expertise based on business needs, thereby saving time and money on recruitment and training.Employers can now access specialized skills on demand, without needing to commit long-term to full-time employees as they did before.However, this new shift also brings challenges, such as the difficulty in maintaining team cohesion, which may also lead employees to be less willing to commit to the company’s long-term goals.Legal considerations have also become more complex, and employers need to carefully classify workers to avoid issues related to misclassification.Despite these challenges, many organizations have found that integrating gig workers into their workforce strategies can make them more competitive and better equipped to respond to market demands.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Editor: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"