The Chinese market is enormous and cannot be ignored.

Image source: Unsplash

Spencer Feingold

Digital Editor, World Economic Forum

A survey by the U.S.-China Business Council reveals that tariffs and trade tensions have prompted U.S. companies to cut back on their investments in China.

The report noted: "Intermittent talks have shaken business confidence."

At this year's World Economic Forum Annual Meeting of the New Champions, held in Tianjin, China, China-U.S. trade was one of the key topics discussed.

A recent survey reveals that, as tariffs and trade tensions continue to strain relations between the world’s two largest economies, U.S. companies have slashed their investments in China to an all-time low.

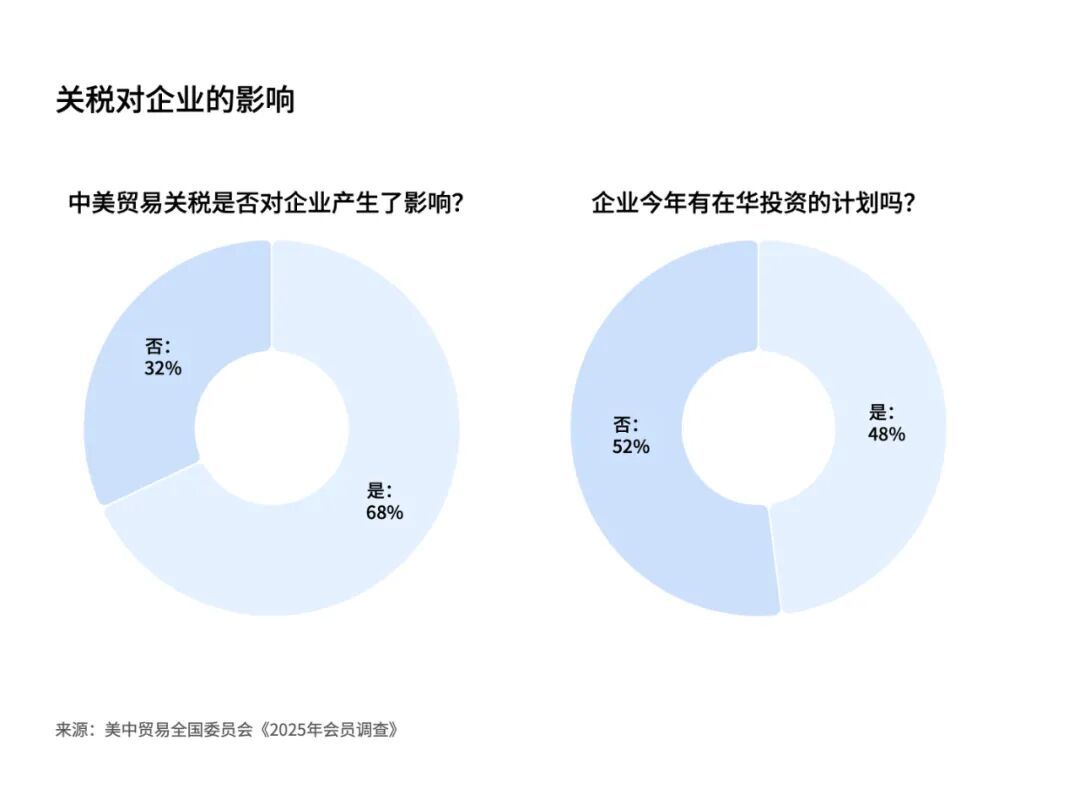

According to the 2025 Member Survey released by the U.S.-China Business Council (USCBC), only 48% of U.S. companies plan to invest in China this year—far lower than the 80% recorded in 2024. Additionally, the survey reveals that businesses are growing increasingly pessimistic about China’s economic growth prospects, while their confidence in improving U.S.-China relations remains low as well.

USCBC is a non-partisan, nonprofit organization comprising more than 270 major U.S. companies operating in China. The survey was conducted from March to May 2025, a period when U.S. President Donald Trump reignited the U.S.-China trade dispute as part of his broader efforts to overhaul U.S. trade policies.

The report noted: "The spiraling tariffs that followed April 2, coupled with intermittent rounds of talks, have shaken business confidence, disrupted investment plans, and heightened tensions in broader bilateral relations."

Concerns about tariffs are soaring.

American businesses operating in China are increasingly concerned about the ongoing rise and volatility of tariffs.

According to a 2025 survey conducted by USCBC, tariffs were ranked as the second most pressing challenge facing U.S. businesses, trailing only the overall U.S.-China relationship; in contrast, in 2024, tariffs were listed as just the eighth most urgent challenge. The report also revealed that nearly 70% of companies have been directly affected by tariffs, while 88% are impacted by the broader dynamics of U.S.-China relations.

"The tense situation is forcing companies to reassess their investment strategies in China," the report notes. "Faced with structural challenges in the economy and recent political turmoil, many U.S. firms are now reshaping their supply chains and scaling back new investments in China—albeit in the short term."

Tariffs have also led to economic losses. The survey found that more than one-third of companies experienced a decline in sales due to the additional tariffs imposed by the U.S. Moreover, amid uncertainty, Chinese customers have shifted their sourcing to suppliers outside the U.S., causing sales to drop for about half of the businesses surveyed. Additionally, 27% of companies reported a sales decline as a result of China’s own tariff hikes—representing a significant increase of 21 percentage points compared to 2024.

To address these challenges, companies are renegotiating prices with suppliers while simultaneously shifting their supply chains to other international markets. The survey reveals that the top three alternative markets are Southeast Asia, India, and Mexico.

“The business community simply hopes to continue growing—and to expand into regions where there’s demand and where their operations can thrive most effectively,” said Margery Kraus, Founder and Executive Chairman of APCO, speaking at the World Economic Forum Annual Meeting of the New Champions in Tianjin, China. “Supply chain disruptions have already prompted some companies to invest elsewhere, pursuing diversification and decoupling as strategic responses.”

Nevertheless, the USCBC report found that the vast majority of surveyed companies remained profitable. However, less than half of the businesses remain optimistic about the future, due to ongoing concerns over tariffs and policy uncertainties.

The USCBC survey also revealed that several other factors are making the business environment for U.S. companies in China increasingly complex. These include heightened competition with Chinese firms, U.S. export controls, China’s industry policies, and localization measures that restrict market access.

China's economic growth and fluctuations in domestic demand are also key concerns for businesses. Over the past two years, China has set its GDP growth target at 5%; however, as highlighted in the World Economic Forum’s "Chief Economist Outlook" released in May 2025, achieving the 5% growth target in 2025 "may prove even more challenging, given the ongoing turbulence in global trade patterns over recent months."

The survey reveals that, in response to the volatile situation, U.S. companies are focusing on serving their core markets, cutting costs, and boosting efficiency—while also targeting new customer segments, particularly China’s third-tier cities, where consumer spending is on the rise.

"The market is huge and cannot be ignored."

Despite significant economic challenges and ongoing uncertainty, the USCBC survey highlights that U.S. companies cannot afford to abandon the Chinese market.

"American companies must have the ability to operate in China’s highly competitive market—this is non-negotiable. This capability not only enables businesses to tap into the growing middle class but also helps foster cutting-edge technologies and practices that are critical for maintaining global competitiveness," added USCBC President Sean Stein in a statement.

The survey found that 28% of the companies surveyed believe they would struggle to remain competitive in the global market without their operations in China. Additionally, nearly 40% of businesses stated that China is a critical component of their global expansion strategy.

"The Chinese market is enormous and cannot be ignored," the report notes. "However, without substantial tariff reductions and improved market access conditions, confidence will remain elusive."

The above content represents the author's personal views only.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment at the end of the post or on our official account if you’d like to republish.

Translated by: Di Chenjing | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"