The green bond market is growing exponentially.

Image source:Karsten Würth/Unsplash

Patrick Henry

Senior Writer for the Forum Agenda

Madeleine North

Senior Writer for the Forum Agenda

The green bond market—funds invested in sustainable projects—is growing exponentially.

According to the World Economic Forum's report, "Driving Effective Energy Transitions (2023 Edition)," green bond issuance reached $270 billion in 2020.

We need to step up efforts to prevent "greenwashing"—this misleading marketing practice.

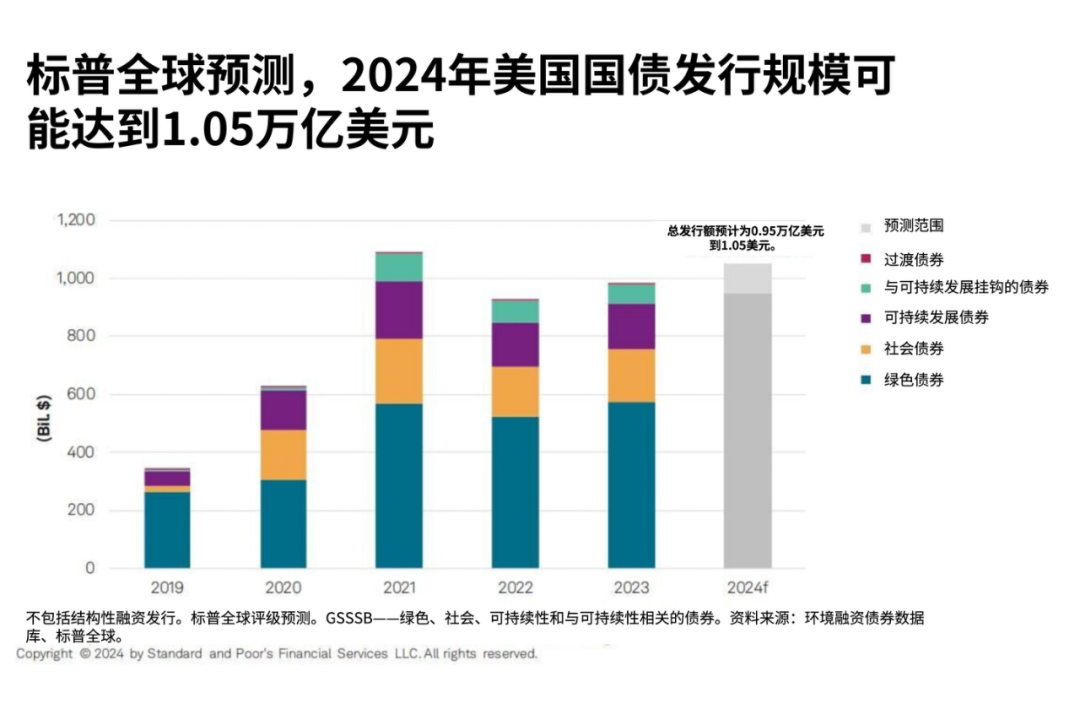

Addressing the climate crisis will require substantial funding. The United Nations Intergovernmental Panel on Climate Change estimates that, to meet the Paris Agreement’s goal of limiting global temperature rise to within 1.5°C, investments exceeding $3 to $6 trillion annually will be needed by 2050.To raise these massive funds, governments and businesses are increasingly turning to green bonds.Green bonds are similar to conventional bonds, but they have one key difference: the funds raised from investors are specifically earmarked to finance projects that deliver positive environmental impacts, such as renewable energy and green building initiatives.As countries around the world ramp up their efforts to reduce carbon emissions, the green bond market is booming. In October 2021, the European Union issued its first green bonds worth approximately $14 billion—a landmark deal that marked the market’s rapid growth at the time.How big is the green bond market?The first batch of green bonds was issued in 2007. Over the following decade, the green bond market grew steadily but slowly—until it suddenly began to experience rapid and robust expansion. Global green initiatives such as the Paris Agreement on Climate Change and the United Nations Sustainable Development Goals have been instrumental in driving the growth of the green bond market.Strong demand for green bonds has also fueled growth, as major investors such as asset management firms, insurance companies, and pension funds eagerly snap up these environmentally friendly securities.In November 2023, Brazil issued its first green bond, aimed at supporting President Luiz Inácio Lula da Silva’s ambitious plan to protect the Amazon.Driven jointly by political leadership and investor interest, the green bond market is steadily expanding.According to data from S&P Global, the annual issuance volume of all GSSSB (Green, Social, Sustainability, and Sustainability-Linked Bonds) is projected to rise from $980 billion in 2023 to $1.05 trillion in 2024.Although this remains a niche market within the global bond arena, by 2024, GSSSB could account for up to 14% of global bond issuances. As a result, both GSSSB and green bonds still have ample room to continue growing.All green bonds and GSSSBs expected to be issued in 2024.

Image source:S&P Global

Where do green bonds come from?In 2007, the European Investment Bank, an EU lending institution, issued the first-ever green bond. A year later, the World Bank followed suit by also launching its own green bond. Since then, numerous governments and corporations have entered the market, raising capital to finance sustainable, environmentally friendly projects.The United States is one of the largest issuers of green bonds, led by Fannie Mae, the government-backed mortgage giant. Companies ranging from Apple to PepsiCo and Verizon Communications are also getting involved. Meanwhile, state and local governments are increasingly turning to green bonds to finance critical infrastructure projects.According to S&P Global data, total green bond issuances reached $575 billion in 2023, representing a 10% year-on-year increase. This was primarily driven by higher issuance volumes in Europe, while U.S. issuance saw a decline.S&P Global reports that non-financial corporations continue to hold the "largest share of the green bond market," but after three consecutive years of growth, the financial services sector now has issuance volumes that are virtually on par with the overall size of the green bond market.Green bonds operate within the debt capital market, providing funding for climate and environmental solutions.The most common type is the "use-of-proceeds" bond, where the funds raised are earmarked specifically for a particular green project but are backed by the issuer's entire balance sheet.The issuance process involves several steps, including identifying eligible green projects, establishing a green bond framework aligned with the Green Bond Principles, and typically requiring third-party verification.There are various types of green bonds available in the market, each with its own unique features. These bonds include "use-of-proceeds" bonds, revenue bonds, project bonds, securitization bonds, and collateralized bonds.For example, project bonds are limited to specific underlying green projects, and investors have recourse only to the assets of those individual projects. In contrast, securitized bonds pool multiple projects into a single debt portfolio.The management of funds raised through green bonds typically involves tracking, allocation, and reporting to ensure transparency and maintain investors' confidence in the bonds' green credentials.Leading green bond underwriters in the first half of 2020.

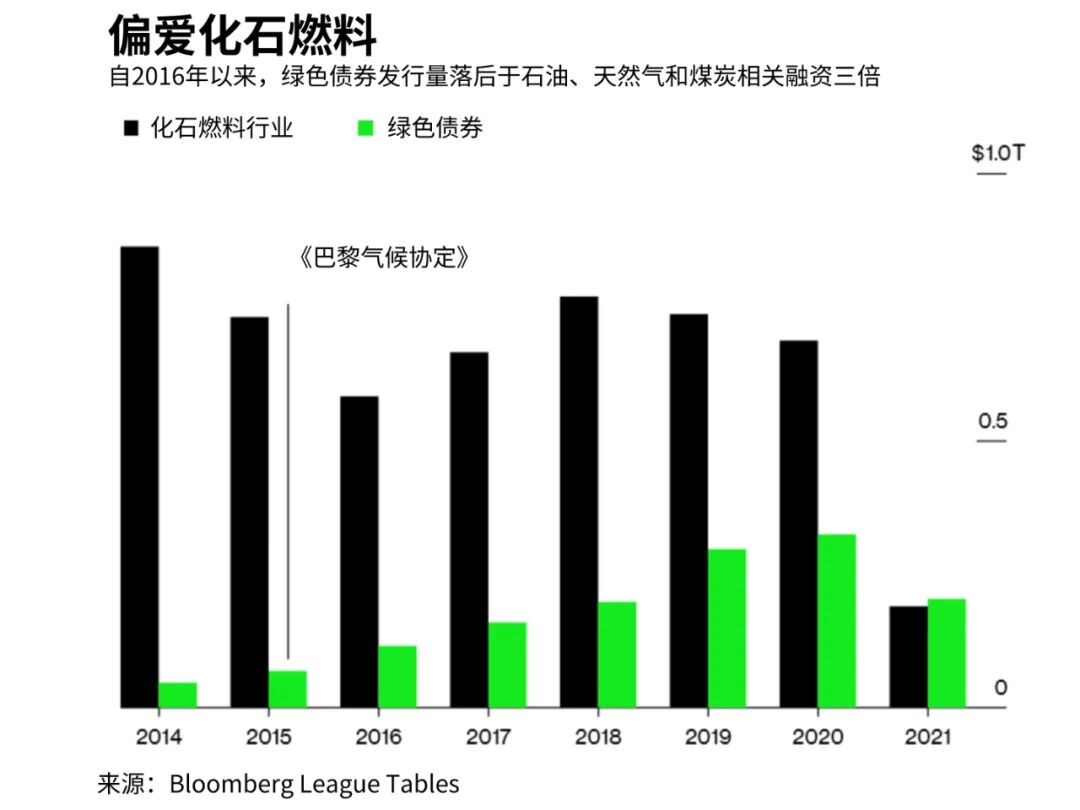

Image source:GB-TAP/IFC

What benefits will green bonds bring to issuers?Issuing green bonds offers organizations several key advantages. First, it enhances the issuer’s reputation by demonstrating a commitment to environmental sustainability, thereby boosting public perception and strengthening relationships with stakeholders.Green bonds can also attract a broader range of investors, including those focused on socially responsible investing, potentially leading to oversubscription and more favorable pricing. Expanding the investor base helps diversify funding sources and may ultimately reduce borrowing costs.Additionally, green bonds may offer tax incentives in certain jurisdictions, such as tax exemptions or credits, making them more attractive than comparable taxable bonds.By issuing green bonds, companies and governments can align their financing strategies with the Sustainable Development Goals, potentially attracting environmentally conscious customers and partners in the process.How is it different from other bonds?While green bonds are specifically designed to finance environmental projects, they share similarities with other sustainability-focused bonds—though their purposes differ.For example, blue bonds are a subset of green bonds, used to finance projects that protect oceans and their associated ecosystems.The concept of climate bonds is sometimes used interchangeably with green bonds, but it focuses more specifically on projects aimed at reducing carbon emissions or mitigating the impacts of climate change.Structurally, green bonds typically resemble standard bonds, sharing identical financial features such as priority, maturity, credit rating, and interest rate. The key distinction lies in the "use of proceeds"—the funds raised from green bonds are earmarked exclusively for financing environmentally friendly projects.Unlike traditional bonds, green bonds require additional documentation, such as a green bond framework, to outline the selection, management, and reporting of green projects.How do I know these bonds are green?Greenwashing—making false or misleading claims about the environmental credentials of companies or financial products—is a major challenge facing the green bond and other sustainable investment markets. Regulatory bodies and the industry itself are actively working to address this issue.Many borrowers adhere to the Green Bond Principles, which have been endorsed by the International Capital Market Association and help enhance market transparency. Additionally, a growing number of companies offer bond evaluation and certification services.The EU has enhanced transparency further by voluntarily issuing European Green Bonds. This move aims to equip investors with sufficient information, enabling them to evaluate and compare bonds marketed as "green," thereby supporting the growth of the market.What does the future hold for green bonds?Despite the urgent need to tackle the climate crisis, in the years following the signing of the Paris Agreement, the fossil fuel industry received significantly more funding than green initiatives. However, Bloomberg Green reports that this dynamic shifted in 2021, suggesting we may now be at a turning point in the fight to save our planet.According to the World Economic Forum's "Enabling Effective Energy Transitions (2023 Edition)" report, the green bond market continues to grow rapidly, with the report noting that green bond issuances reached $270 billion in 2020.It turns out that 2021 was a turning point for sustainable investing.

Image source:Bloomberg League Tables

As governments worldwide prioritize climate issues, sustainable investments appear set to maintain their rapid growth. These initiatives include Europe’s Green Deal and U.S. President Biden’s infrastructure framework.Green bonds will continue to be a key driver of sustainable development, providing financing for major projects around the world.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment below the post if you’d like to republish.

Editor: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"