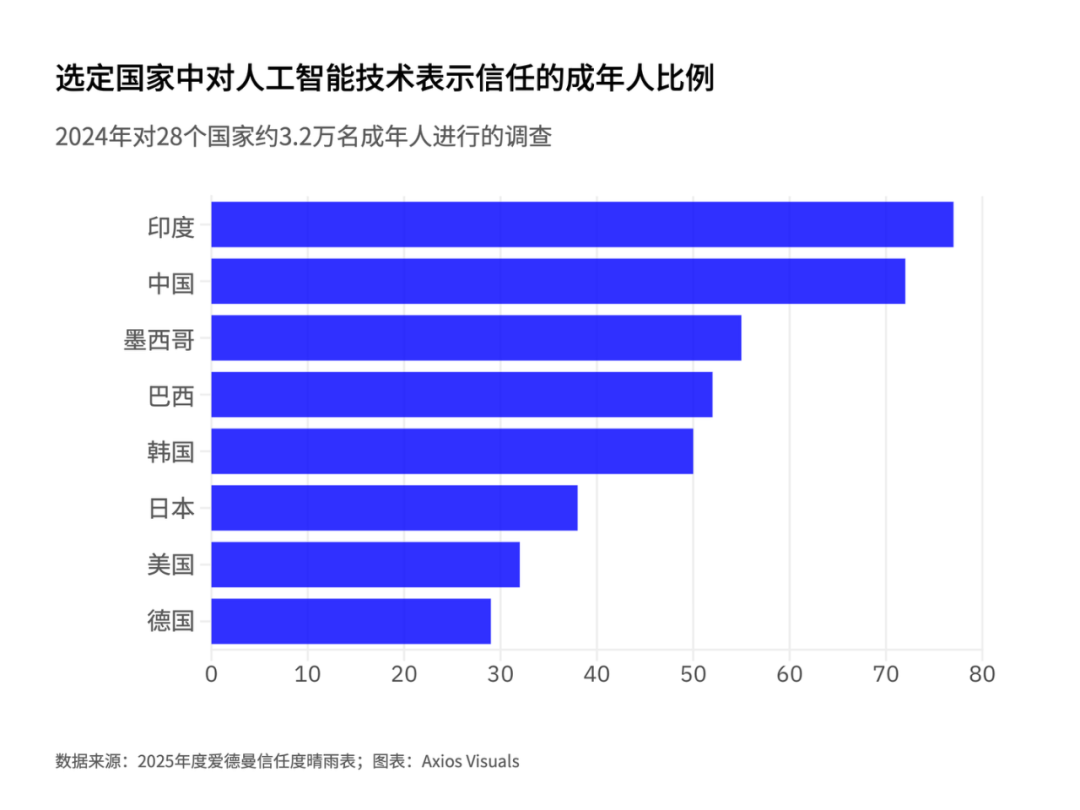

China's optimistic attitude toward technology has fueled its rise in the tech sector.

Image source: REUTERS/Florence Lo/File Photo

Kaiser Kuo

World Economic Forum Contributor

Host of the Sinica Podcast

From DeepSeek to MiniMax, China's latest breakthroughs in generative AI are the result of years of national strategy, public-private collaboration, and investments in both talent and infrastructure.

Despite U.S. export controls on advanced chips, Chinese AI companies have adapted by embracing architectural innovation, enhancing efficiency, and fostering open-source collaboration—marking a pivotal shift from dependency toward resilience and self-reliance.

China's culture of technological optimism, its well-coordinated and orderly system, and the sophistication of its regulatory framework have enabled artificial intelligence to achieve rapid, large-scale development at an unprecedented pace.

Over the past year, China's generative AI sector has seen a series of remarkable developments.

DeepSeek's open-source models, such as R1 and V3, deliver performance metrics that rival their U.S. counterparts—and in some cases even outperform them—despite being subject to U.S. export controls. Other models have also shown impressive results, including Alibaba’s Qwen3, which ranks among the world’s top performers in both reasoning and language tasks. Meanwhile, the newer MiniMax M1, trained using just 512 NVIDIA H800 GPUs, has successfully challenged leading Western models in competitive benchmarks.

These breakthroughs have left the U.S. tech and policy communities in shock, sparking a reaction reminiscent of the "Sputnik moment."

However, this very shock is itself surprising. If we take a more sober look at China’s structural position within the global AI ecosystem—considering its extensive STEM education programs, dense computing infrastructure, robust foundation in applied research, and the coordinated capacity of its governance system in terms of investment, policy, and talent—we’ll realize that this level of performance was actually predictable.

My personal perspective is largely shaped by my years of experience in China’s tech industry. This includes my time at Baidu, which coincided with the early surge of the AI boom. From 2013 to 2016, I worked closely with Andrew Ng, a pioneer in machine learning, and witnessed firsthand Baidu’s co-founder and CEO Robin Li Yanhong’s unwavering commitment—at both the individual and organizational levels—to positioning AI as the cornerstone of the company’s future. Over the past several years, through conversations with researchers, entrepreneurs, and policymakers—discussions I’ve also shared on the Sinica Podcast—I’ve continually refined and deepened this understanding.

These developments didn’t emerge out of thin air—here are some key factors driving such rapid progress.

Quietly building a world-class AI ecosystem

DeepSeek and Qwen stunned Western observers from late 2024 to early 2025, but in fact, the rise of China’s generative AI ecosystem had already been firmly established nearly a decade earlier. In 2017, the State Council unveiled the "New Generation Artificial Intelligence Development Plan," positioning AI as a national strategic priority. Following this, provinces and cities across the country swiftly rolled out their own tailored implementation plans, while state-backed venture capital instruments ensured ample funding support. Meanwhile, regulatory sandbox mechanisms have provided AI startups with significant operational flexibility.

Chinese enterprises have responded enthusiastically. By 2022, China had already filed four times more AI-related patent applications than the United States, and the gap in cutting-edge research outcomes is steadily narrowing. By 2024, thanks to architectural innovations such as expert blending and multi-head latent attention, models like DeepSeek-V3 have surpassed Meta’s Llama 3.1 and Anthropic’s Claude 3.5 Sonnet in popular language and reasoning benchmark tests.

The emergence of new players like MiniMax reflects the rapid maturation of China's indigenous AI ecosystem. Meanwhile, established leaders such as Baidu, Tencent, and Zhipu AI continue to iterate their large language models, steadily enhancing their capabilities, versatility across tasks, and ability for large-scale deployment.

A common narrative suggests that China’s AI industry will come to a standstill without access to advanced chips, foreign investment support, or an open research ecosystem. As the U.S. imposes stringent export controls on critical areas of China’s semiconductor sector—and even bans U.S. personnel from engaging in related work—many predict that China’s high-tech industry will suffer a devastating blow.

However, the steady accumulation of institutional strength and industrial capabilities tells a different story. As many have noted, China didn’t achieve its leap forward overnight—but instead, it has steadily advanced over the years through years of strategic policy governance and extensive public-private collaboration. Today, China has nurtured a society that isn’t skeptical about AI; on the contrary, it’s deeply enthusiastic about it.

Responding to Export Controls with Innovation

Over the past five years, the U.S. has been actively pursuing export controls—particularly on exports to China—to safeguard its global leadership in the field of artificial intelligence. These measures first took shape when companies like Huawei were added to the U.S. Department of Commerce’s Entity List, and they escalated further in October 2022, imposing strict restrictions on the export of advanced AI chips (such as NVIDIA’s A100 and H100) as well as semiconductor manufacturing equipment. Even customized, lower-performance versions like NVIDIA’s H800 and A800 were ultimately banned from export by October 2023.

While these controls have significantly widened the gap between Chinese and U.S. AI companies in terms of computing power in the short term, they’ve also sparked a wave of spontaneous creativity and efficiency-driven innovation within China’s AI industry. For instance, DeepSeek made global observers take notice in January 2025 with the release of its R1 model. The company claimed that this model was trained using just around 2,000 NVIDIA H800 GPUs—at a cost of only $5.6 million—far surpassing the computational resources and financial investment required for comparable Western models at the time.

Several Chinese companies, including those behind DeepSeek’s High-Flyer AI, reportedly stockpiled tens of thousands of A100 chips well before the export restrictions took effect. Meanwhile, other firms are said to have sourced GPUs through intermediaries based in Southeast Asia. Despite these temporary logistical workarounds, the longer-term strategy remains fundamentally structural: China is steadily ramping up investments in domestically developed chip designs—most notably exemplified by Huawei’s Ascend series—and significantly boosting its domestic semiconductor manufacturing capabilities. Notably, SMIC is reported to have already mastered deep ultraviolet (DUV) lithography technology, enabling it to produce chips as a viable alternative to the cutting-edge extreme ultraviolet (EUV) technology, which is currently monopolized by the Dutch company ASML and restricted by U.S. export controls.

Meanwhile, innovation at the architectural level has become particularly urgent. Faced with stringent limitations in computing power, Chinese model developers are actively working to enhance efficiency, striving to reduce training costs without compromising performance. DeepSeek’s adoption of a sparse expert mixture model and its memory-efficient inference pipeline is a prime example of this trend. The company has also embraced an open-source release strategy, including making models available under permissive licenses, which appears to be fostering stronger collaboration—both domestically and internationally. Several industry observers from China whom I’ve spoken with have noted that DeepSeek’s success further underscores the nation’s growing enthusiasm for supporting open-source development, viewing it as a proactive measure to mitigate reliance on foreign platforms and reduce geopolitical risks.

The practical effect of export controls has been to reinforce the drive among China’s AI engineers, entrepreneurs, and investors to "do more with less," pushing them to optimize performance per watt, per dollar invested, and per GPU. Far from hindering China’s AI momentum, these restrictions have instead spurred the industry to become more resilient and self-reliant.

China's advantages in technology adoption

A key yet often underestimated dimension of China’s AI strength lies not only in its "cutting-edge innovation" but, more significantly, in its remarkable ability to rapidly and widely deploy general-purpose technologies like large language models across industries, government sectors, and consumer markets. In his book *The Rise and Fall of the East*, MIT’s Haiyan Huang delves deeply into China’s capacity for large-scale implementation. Meanwhile, scholars like Jeffrey Ding have compellingly distinguished between "frontier innovation" and "technology diffusion." Ding highlights that, in transformative technology fields, a nation’s true strength lies less in its initial inventions and more in its institutional capability to integrate these technologies seamlessly into the broader economic system—a metric where China, he argues, actually remains relatively weaker. However, Ding’s approach is somewhat narrow, as he measures this by counting only the number of institutions from a given country that have published at least one paper at one of the three top-tier AI conferences. While this observation holds some truth, I believe China still enjoys a decisive structural advantage when it comes to scaling and deploying these technologies effectively.

,,AI,,,AI

,,,,(,),,

,,

,(),,,

vs

“”,“”,,

,AI,“”,,,,“”

,,,Kendra Schaefer,(CAC)AI,,,

,,,,,AI,

,AI,,

AI,,,:,,

,,AI,AI,,,

,2010“”,AI,,AIDeepSeekMiniMax,,

DeepSeekDeepSeekR1MIT,,,AI,——API,

NeurIPSACL,,,,,

,,,,

The Inevitability of China's Rise in Generative AI

None of this should come as a surprise.

China’s rapid rise in the field of generative AI is not a geopolitical surprise—but rather the logical outcome of a series of strategic decisions made years ago: prioritizing education in technology, investing in high-performance computing infrastructure, mobilizing talent on a massive scale, aligning national strategy with academic research and private-sector innovation, and fostering a regulatory environment that, while distinct from Western norms, is remarkably proactive and adaptable. While headlines often focus on chip bans and export controls, the real foundation for this success lies in scalability, coordination, optimism, and unwavering commitment—factors that far outweigh short-term geopolitical tensions.

Those who attribute China’s future prospects solely to its access to NVIDIA GPUs are missing the bigger picture. They’ve failed to recognize the country’s society-wide, collaborative approach to emerging technologies—combining not just groundbreaking innovation capabilities, but also the unique ability to scale and deploy these advancements rapidly, enabling China to close the gap at an astonishing pace. Moreover, they underestimate China’s sophisticated approach to AI regulation, exemplified by mechanisms like algorithm registration and content oversight, which already place the nation ahead of the EU in several key areas. Finally, they misjudge the cultural climate in China, where tech professionals continue to enjoy genuine respect—rather than being viewed with suspicion as potentially “tech bros” with questionable motives—and where the vision of “machines making the world a better place” remains untainted by cynicism.

As generative AI continues to evolve, it would be immensely beneficial for global discussions to shift away from sensationalized "shock" narratives and instead focus more deeply on the systems driving progress—whether in education, industry, ideology, or even cultural spheres. China’s approach may not be flawless, but its rise in the AI arena underscores not only its resilience—but perhaps more importantly, it reflects a well-calibrated strategic vision.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment at the end of the post or on our official account if you’d like to republish.

Translated by: Di Chenjing | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform designed to bring together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Channels, Douyin, and Xiaohongshu!

"World Economic Forum"