Home/News/New research reveals that retail investing is shifting toward younger investors, reshaping market trends./

New research reveals that retail investing is shifting toward younger investors, reshaping market trends.

2025-03-26

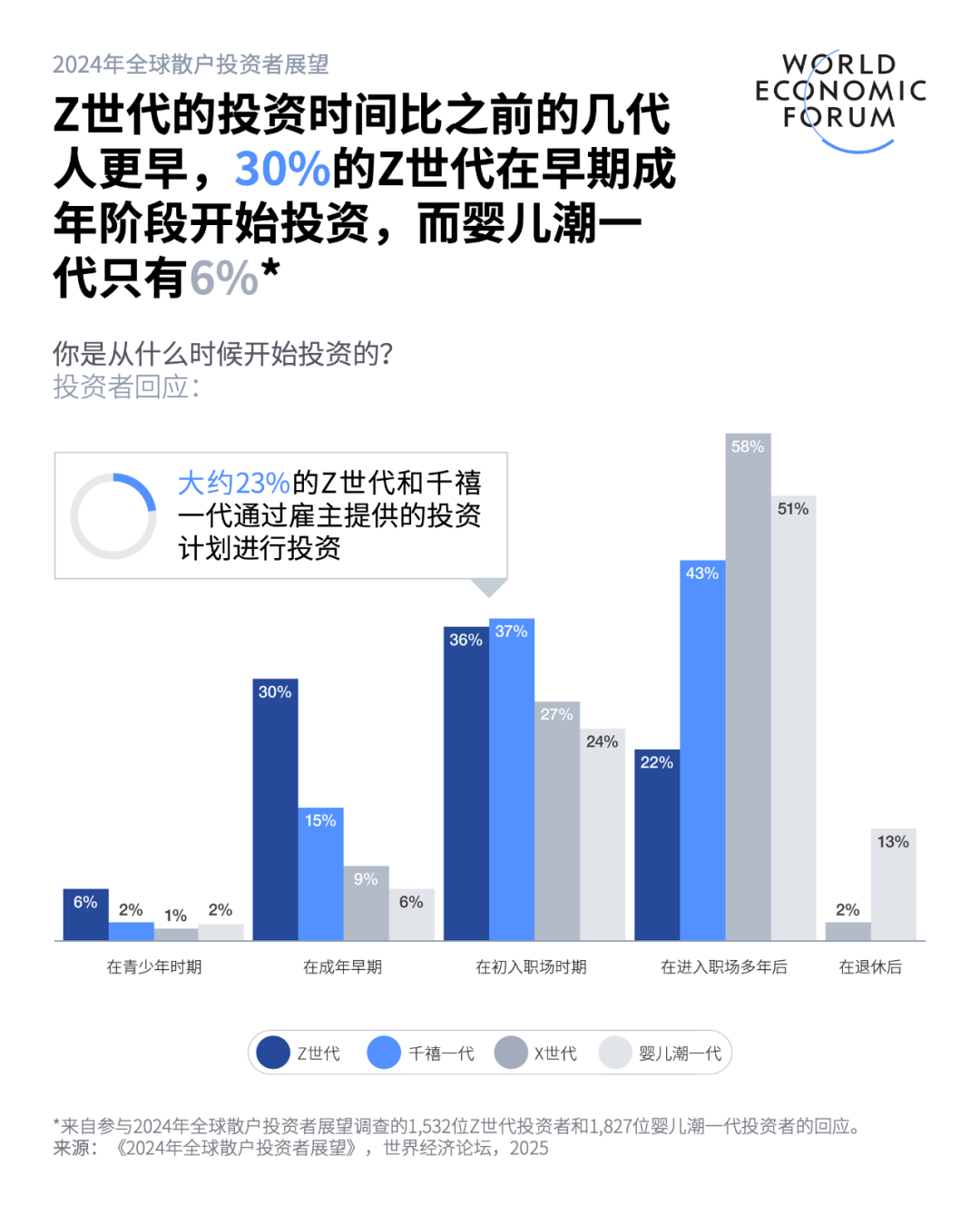

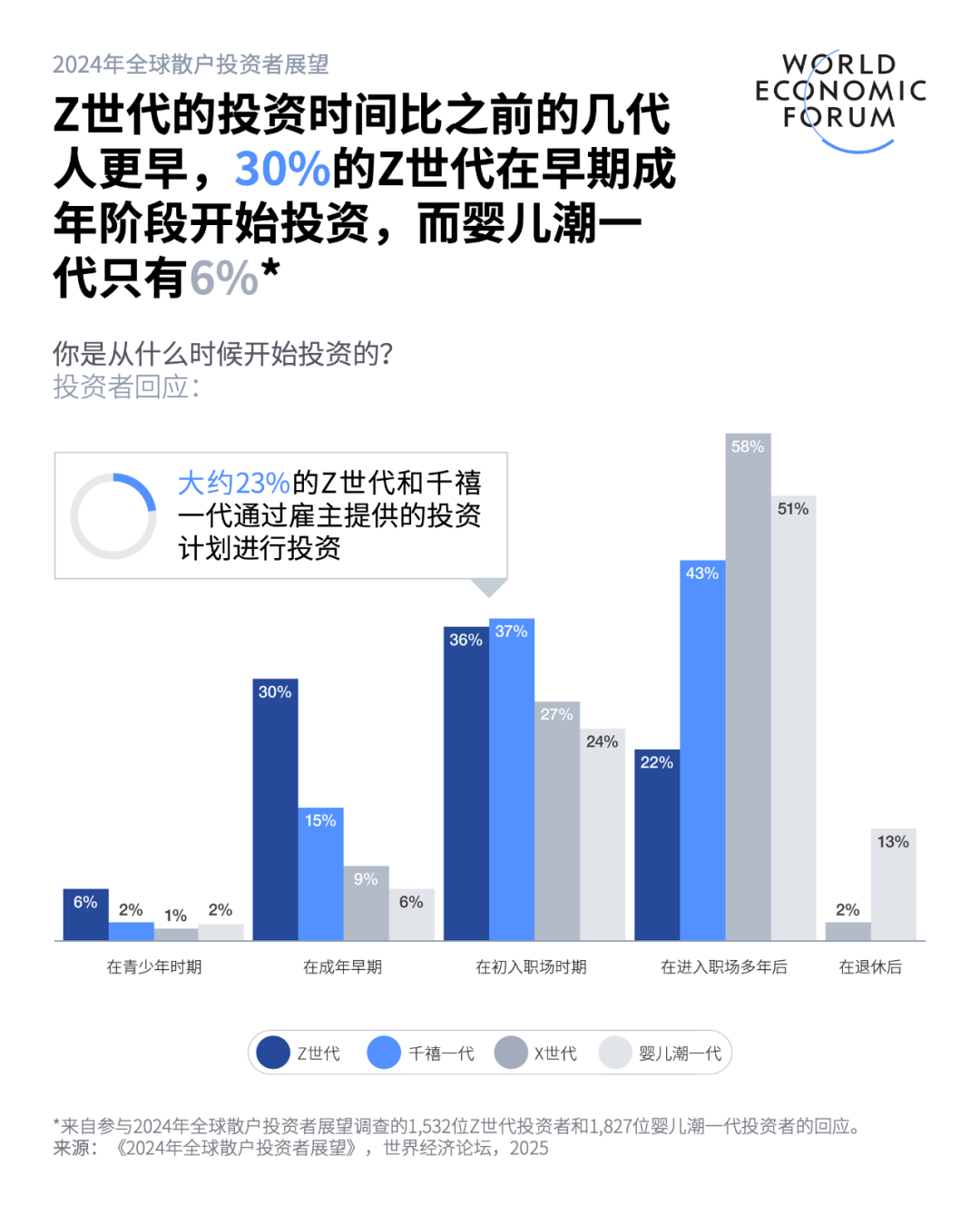

- A new survey reveals that 30% of Generation Z started investing during college or in their early adulthood, compared to 15% of Millennials, 9% of Generation X, and just 6% of Baby Boomers.

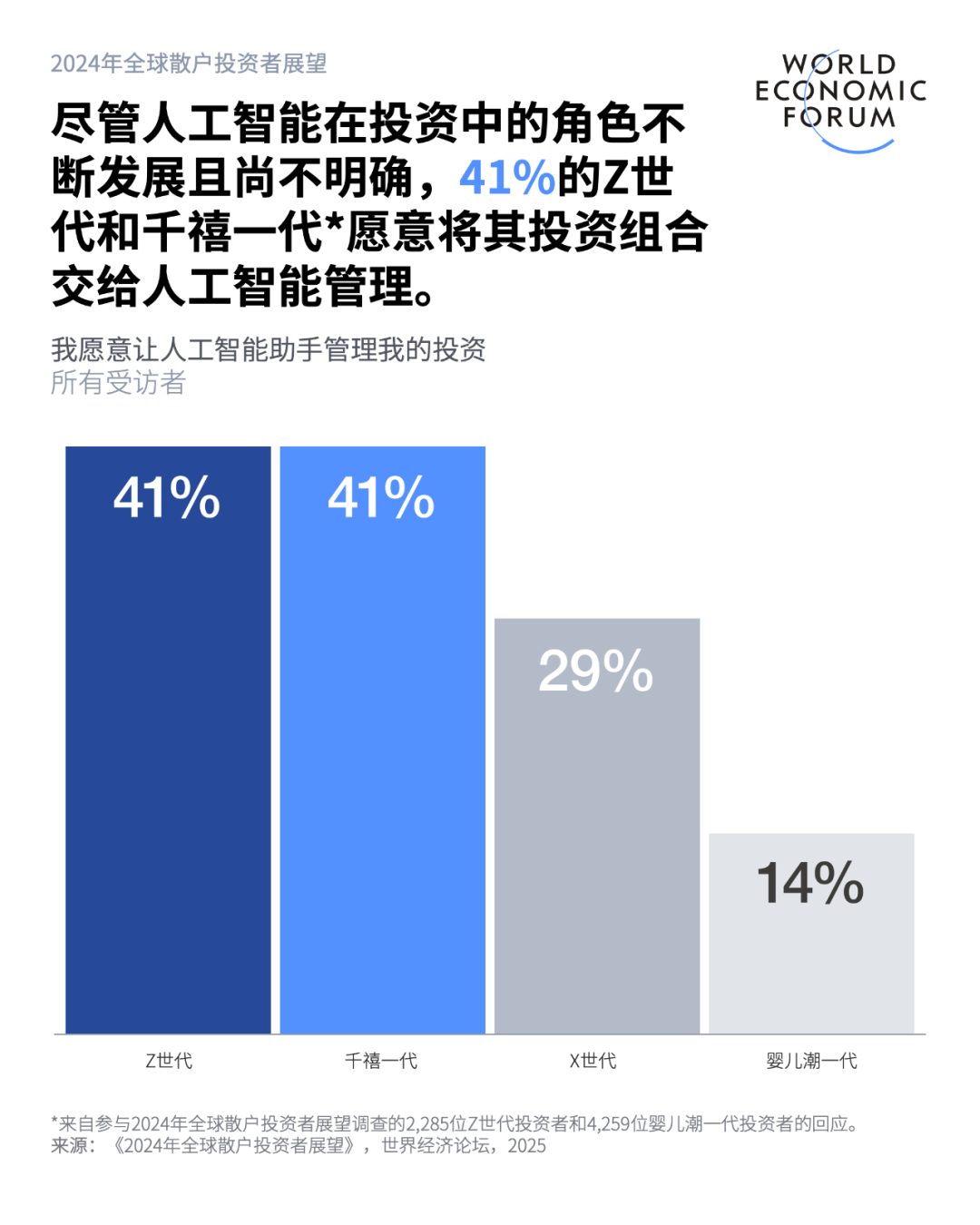

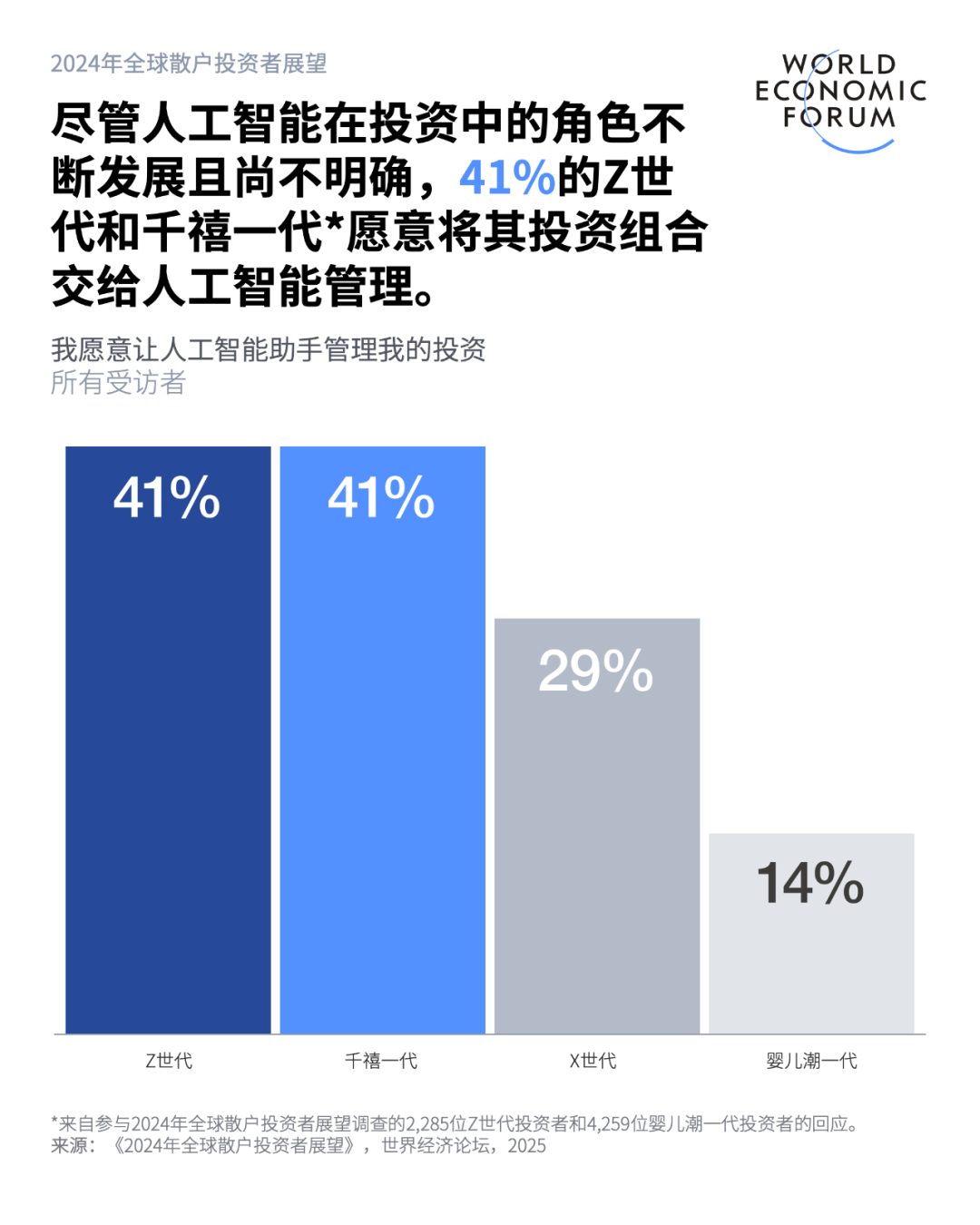

- The younger generation is also more open to embracing tech- and AI-backed financial advice, with 41% of Gen Z and Millennials saying they’d allow an AI assistant to manage their investments.

- "The 2024 Global Retail Investor Outlook," based on insights from more than 13,000 respondents across 13 countries, explores investor needs and ways to broaden market participation.

- To read the report, please click "Read the Original Article" at the end of the text.

The World Economic Forum’s "2024 Global Retail Investor Outlook," released today, confirms the ongoing trend of retail investors increasingly shifting toward younger demographics. The study, which surveyed 13 economies, found that 30% of Generation Z began investing in their early adulthood—compared to just 9% of Generation X and 6% of Baby Boomers. Additionally, by the time they enter the workforce, 86% of Gen Z already have a basic understanding of personal investing, whereas only 47% of Baby Boomers do, highlighting a clear generational shift in financial habits.

This latest global study, conducted jointly by the World Economic Forum, Robinhood Markets, and Boston Consulting Group, highlights emerging technology trends. Younger generations are more open to tech-driven and AI-backed financial advice: 41% of Gen Z and Millennials say they’d allow an AI assistant to manage their investments, compared to just 14% of Baby Boomers who feel the same way.“The younger generation, as well as individuals in emerging markets, are increasingly interested in building wealth and enhancing financial stability through investing,” said Natalya Guseva, Head of Financial Markets and Resilience at the World Economic Forum. “Given the ongoing shift in investor demographics, leaders must reassess the retail investment landscape and ensure that individual investors have access to the right financial education and investment tools to support their financial goals.”The survey found that retail investors increasingly view cryptocurrencies as easier to understand compared to traditional investments such as ETFs, mutual funds, bonds, and stocks. While 29% of respondents avoid stocks due to a lack of knowledge, only 24% hold the same cautious stance toward cryptocurrencies. Among cryptocurrency-holding investors under the age of 44, more than half have allocated at least one-third of their investment portfolios to digital assets.Financial priorities are shifting toward short-term needs. In 2024, 51% of investors are prioritizing emergency savings, up from 41% in 2022; meanwhile, the proportion of investors focused on having sufficient retirement funds has dropped from 48% to 42%.For non-investors, the biggest obstacles are lack of capital and fear of financial loss. More than half of respondents said they would feel more confident about investing if they had learned about it back in elementary school.In addition to young investors being more open to AI-driven financial advice, the survey also found that 48% of individuals across all age groups in emerging markets would allow an AI assistant to manage their investments.

"Innovative financial advisory tools, such as AI-powered products, can fill the gaps that traditional financial advice might leave—gaps often caused by high costs or limited accessibility," said Stephanie Guild, Senior Director of Investment Strategy at Robinhood and a CFA charterholder. "By lowering the entry barrier and enhancing digital advice with intuitive, built-in guidance, these innovations can help make financial consulting more accessible, empowering more people to engage in the markets with greater confidence."The Benefits of Retail Investor Investing“Individual participation in the capital market can potentially lead to long-term financial well-being,”Boston Consulting GroupManaging Director and Partner Dean Frankle added, "Industry stakeholders must work together to provide retail investors with the best tools, education, and access."To better empower every investor, the study proposes feasible solutions for stakeholders within the retail investor ecosystem.- Developing financial products and platforms that prioritize retail investors——As a new generation enters the capital markets, evolving investor demands will necessitate the development of financial products and platforms that go beyond traditional offerings tailored exclusively for institutional investors. Products designed to address key challenges such as uncertainty, capital constraints, and market volatility can foster inclusivity, boost confidence, and ultimately deliver superior investment outcomes for retail investors.

- Leveraging technology to enhance affordability and accessibility——Technology can make financial advice, portfolio construction, and education more accessible and affordable for retail investors. AI-powered solutions hold the potential to streamline the financial advisory process, enabling investment portfolio design and advisory services to be offered at more affordable prices.

- Implementing policies to empower and protect retail investors——Effective policies should equip investors with the essential tools to confidently navigate the market, while fostering innovation and safeguarding individuals. This could involve expanding automatic pension enrollment, promoting fee-only advisory models that eliminate conflicts of interest, and implementing a robust investor protection framework to help individuals manage risk in alignment with their financial goals.

Robinhood Markets IncBoston Consulting GroupThe World Economic Forum and its partners conducted a survey of more than 13,000 respondents across Australia, Brazil, China, France, Germany, India, Ireland, Japan, Singapore, South Africa, the UAE, the UK, and the U.S. The survey, carried out by Dynata in September 2024, explored the preferences, behaviors, and needs of both investors and non-investors. The insights from this survey formed the foundation of the "2024 Global Retail Investor Outlook." All participants were aged 18 or older.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"