A revolution in scrap metal recycling may be on the horizon.

Image source:Unsplash/Zoshua Colah

Nick Pickens

Director of Research, Metals and Mining Division, Wood MackenzieVice President of Metals and Mining at Wood MackenzieRecycling "energy-transition metals"—such as those found in batteries, electric vehicles, and renewable energy products—holds tremendous growth potential.

The secondary supply chain structure must be upgraded, which can be driven by policies that stimulate domestic processing and consumption.

Manufacturers pursue supply security, which is why vertical integration may emerge in key long-term markets—but it comes at a cost.

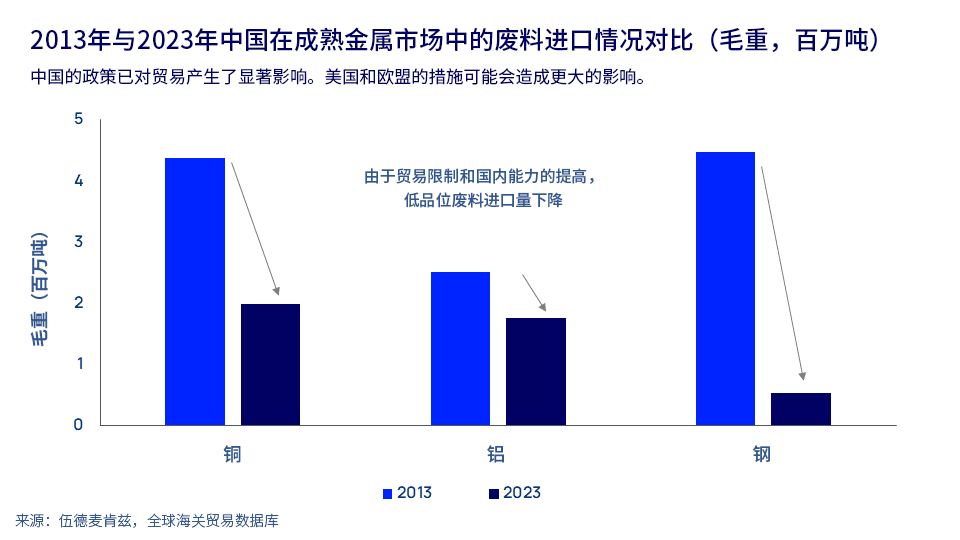

A scrap-metal revolution is on the horizon. The astonishing surge in demand for metals crucial to the energy transition will attract significant investment into metal recycling. While numerous challenges remain to be tackled, the opportunities are immense. So, what’s driving renewed interest in metal recycling?Here are several catalysts driving the continued surge in investments in metal recycling:1. Limited supply of primary metals:The energy transition will be built on electrification and will rely on metal-intensive technologies. Metal recycling can help alleviate the growing shortage of primary metals.2. Carbon emission issues, sustainability demands, and the preference for secondary resources:Steel and aluminum together account for nearly 10% of global carbon emissions. The carbon footprint of producing recycled aluminum is typically 80% to 96% lower than that of primary aluminum production. Meanwhile, using scrap steel in the manufacturing process can usually cut emissions by up to 50%. Additionally, recycling helps prevent reusable materials from ending up in landfills.3. Metal Supply Security Issues:Geopolitical instability and reliance on China for critical minerals have become major concerns for countries like the U.S. and the EU. Utilizing domestically sourced recycled metals can help reduce dependence on imports or a single source of these vital materials.Catalyzing the Scrap Metal RevolutionIf the world is to achieve greater circularity, it must implement structural reforms to address current market dynamics. The following five key trends will significantly impact the metal recycling market:1. Rebalancing the Secondary Metal Supply ChainCurrently, market dynamics for recycled metals are misaligned with the goals of combating climate change and securing supplies of critical materials. Many markets continue to experience significant trade imbalances.Take copper as an example. China processes nearly 3.5 million tons of scrap copper annually, yet only 60% of this comes from domestic sources—relying on imports for the remaining portion. In contrast, North America collects close to 1.5 million tons of recycled copper each year, with more than 40% of it destined for export.Policies promoting the "onshore localization" of scrap metal supplies and curbing exports are becoming increasingly common, particularly through measures like stricter quality standards and import restrictions.We believe these policies will lead to the deglobalization of the scrap metal trade, creating numerous opportunities to enhance scrap metal processing capabilities.Comparison of China's Scrap Imports in Mature Metal Markets Between 2013 and 2023 (Gross Weight, Million Metric Tons)

2. Vertical Integration and Corporate Mergers: Creating a Closed LoopThe scarcity of secondary raw materials can lead to trade disruptions and price volatility. Meanwhile, environmental, social, and governance (ESG) oversight in the industry continues to tighten, highlighting that while recycling scrap metal is a sustainable, low-carbon source of raw materials, building new recycling capacity remains a significant challenge.The best way to ensure a stable supply, quality, and compliance is to gain control over more links in the value chain. However, manufacturers don’t necessarily want to become metal processors, and metal processors aren’t always eager to turn into scrap collectors.New business models and innovative recycling and manufacturing methods hold tremendous potential. A recent deal by Rio Tinto is a prime example. As a mining company, Rio Tinto acquired a 50% stake in Matalco, a leading producer of recycled aluminum billets, gaining control over waste facilities at the upstream end of North America's supply chain and securing a low-carbon supply source.Emerging markets like lithium-ion batteries for electric vehicles (EVs) remain largely untapped in terms of market development—presenting a prime opportunity for innovation and the creation of closed-loop resource systems.3. Alleviate the Tightness in Waste Supply

Unless recycling rates and utilization levels increase, demand for secondary raw materials could lead to a tightening of waste supply. Meanwhile, legislation mandating minimum recycled content will also boost the demand for high-quality materials.Different industry sectors and jurisdictions that utilize the final products also show significant variations in recycling rates. For instance, in the case of aluminum, the recycling rate for used beverage can packaging is 45% in the United States, compared to 90% in Brazil.Take copper as an example—electrodeposition foil manufacturing processes (used to produce foils for electric vehicle batteries) typically rely on high-grade scrap materials, such as clean, pure copper wires or wire ends. As more and more electrodeposition foil plants come online, competition for scrap copper is also expected to intensify.How efficiently and swiftly mobilizing the ever-growing pool of scrap copper resources—through collection, sorting, and finished-product processing—will shape the future landscape.4. The Revolution in Recycling TechnologyIn many mature markets, low-grade waste serves as a marginal supply to meet demand. When primary product supplies are tight, higher-cost production can help make the market more resilient. To secure larger quantities of materials at lower incentive prices, however, technological advancements will be essential.Advances in recycling technology are already boosting the efficiency and quality of scrap metal processing. Innovations in sensing, sorting, and separation technologies are also enhancing recovery rates while minimizing waste from end-of-life products.Digitalization and data analytics also play a crucial role in optimizing operations and enhancing material tracking throughout the scrap metal value chain.5. Disrupting the pricing mechanismThe global pricing mechanism for secondary raw materials is similar to that of many other differentiated commodities. Price discovery is typically conducted by price reporting agencies. While the London Metal Exchange does have a scrap steel futures market, it lacks a sufficiently transparent trading mechanism, creating opportunities for traders and market participants.The pricing of scrap metal is typically based on the prices of the corresponding primary metals. Therefore, when smelters, refineries, and semi-finished product processors purchase scrap metal, they should receive a certain discount based on the metal content. These discounts, in turn, fluctuate depending on the regional supply-and-demand fundamentals for both scrap and primary metals.New regulations, trade tariffs, and carbon policies will impact the cost and value of scrap metal. Carbon pricing and carbon border adjustment mechanisms can make underutilized scrap metal resources more economically viable. These policies may disrupt the historical relationship between scrap metal, primary metals, and resource utilization rates. Importantly, consumer willingness to pay a "green premium" is crucial, as some recycling facilities rely on these premiums to keep their operations profitable.Overall, metal recycling is poised for significant growth. Companies that recognize the opportunities in the recycling market and adapt accordingly can reap both economic and environmental benefits.The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Translated by: Sun Qian | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"