From "financial internet celebrities" to artificial intelligence, the financial advisory sector is rapidly evolving.

Image source:Unsplash/Mathieu Stern

Andrea Willige

Senior Writer for the Forum Agenda

A new report released by the World Economic Forum and Accenture finds that financial consulting is evolving alongside technological advancements and demographic shifts.

Personalized recommendations for lifelong financial health and knowledge are increasingly becoming a key focus area for the industry.

Social media influencers are stepping in to fill the gap left by traditional financial services companies, thereby enabling deeper integration into communities that have historically been underserved.

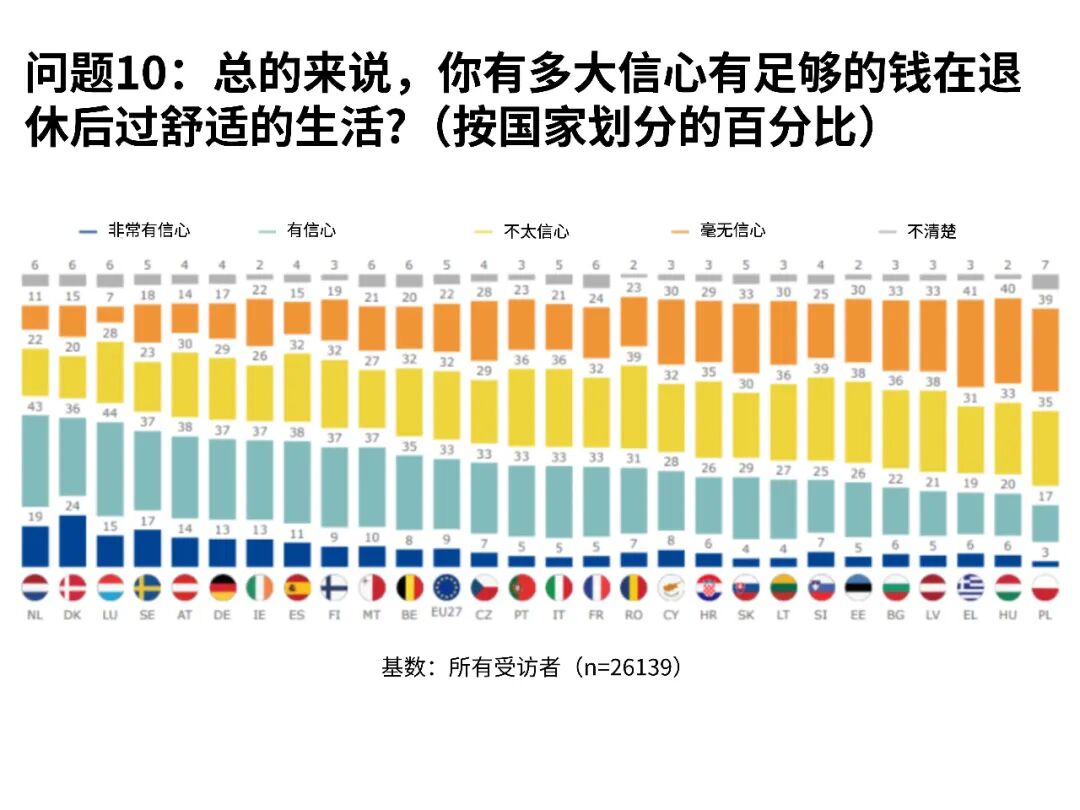

The financial advisory industry is considered conservative, dominated by large, established firms that primarily cater to wealthier financial clients.Today, the landscape has changed dramatically. Rapid technological advancements, shifting demographics, and evolving consumer expectations have profoundly reshaped the industry. A new report titled "The Future of Financial Advice," jointly released by the World Economic Forum and Accenture, explores how financial advisory services are transforming in an increasingly fragmented and complex market environment.It highlights six key trends in the financial advisory market, as well as how policymakers and regulators can ensure access to sound, trustworthy financial advice in an era when financial literacy is more critical than ever before.Europeans aren't confident they'll be able to enjoy a comfortable retirement.

Image source:European Union

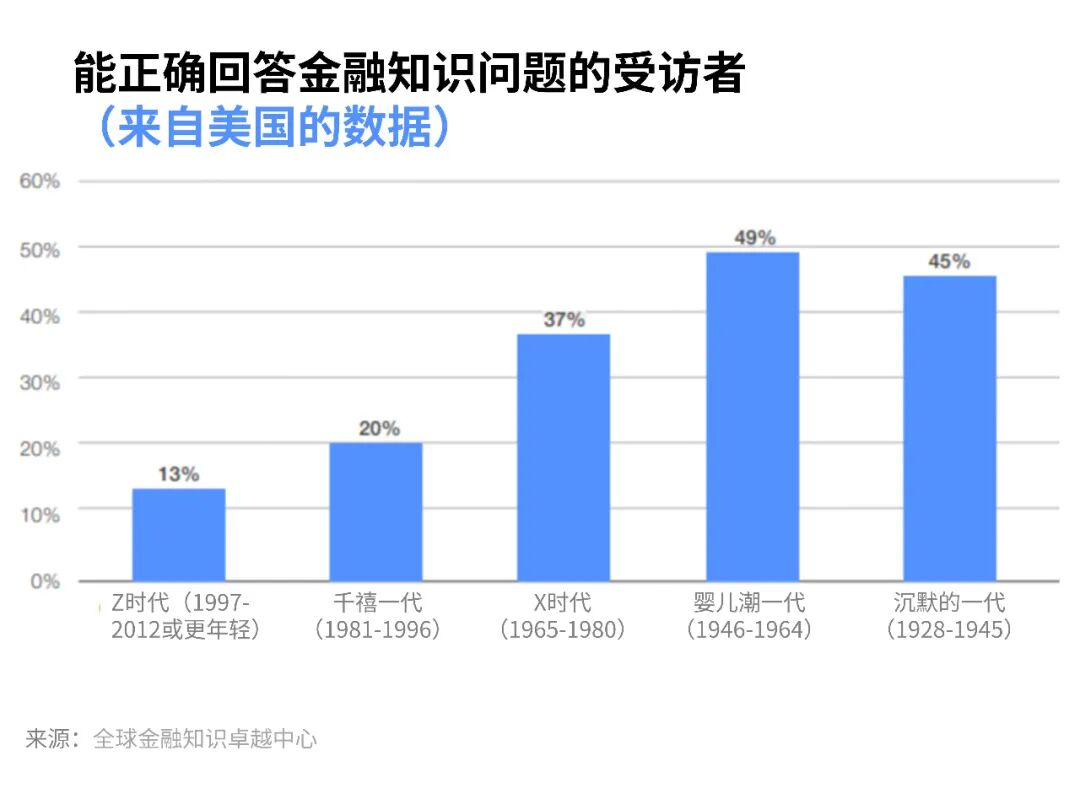

1. Demographic shifts drive the demand for innovationFinancial advice typically accompanies a person throughout their entire life, from investing for the future and managing debt to planning for retirement and estate succession.As life expectancy increases, demographic structures are also shifting, meaning financial advice must adapt to help people build lifelong financial resilience.Extended lifespans, shifting economic conditions, and changes in national pension schemes could lead to insufficient retirement funds for older adults. Recent research indicates that only about half of Americans and EU citizens believe they’ve saved enough money to enjoy a comfortable retirement.The report found that, particularly due to student loans and other factors, young people are entering the financial services market earlier than previous generations.The composition of investors is also shifting, particularly in the U.S., where women and people of color are increasingly participating at higher rates than previous generations.Meanwhile, trust in financial services has been steadily declining, with the forum finding that financial literacy levels are particularly low—especially among younger generations (Gen Z, Millennials, and Gen X).To regain trust, financial institutions need to adapt to a more diverse market. This means recruiting teams that reflect this diversity—teams capable of connecting with these new audiences and developing better strategies to engage and educate them.Financial literacy remains relatively low, especially among the younger generation.

Image source:World Economic Forum, Accenture

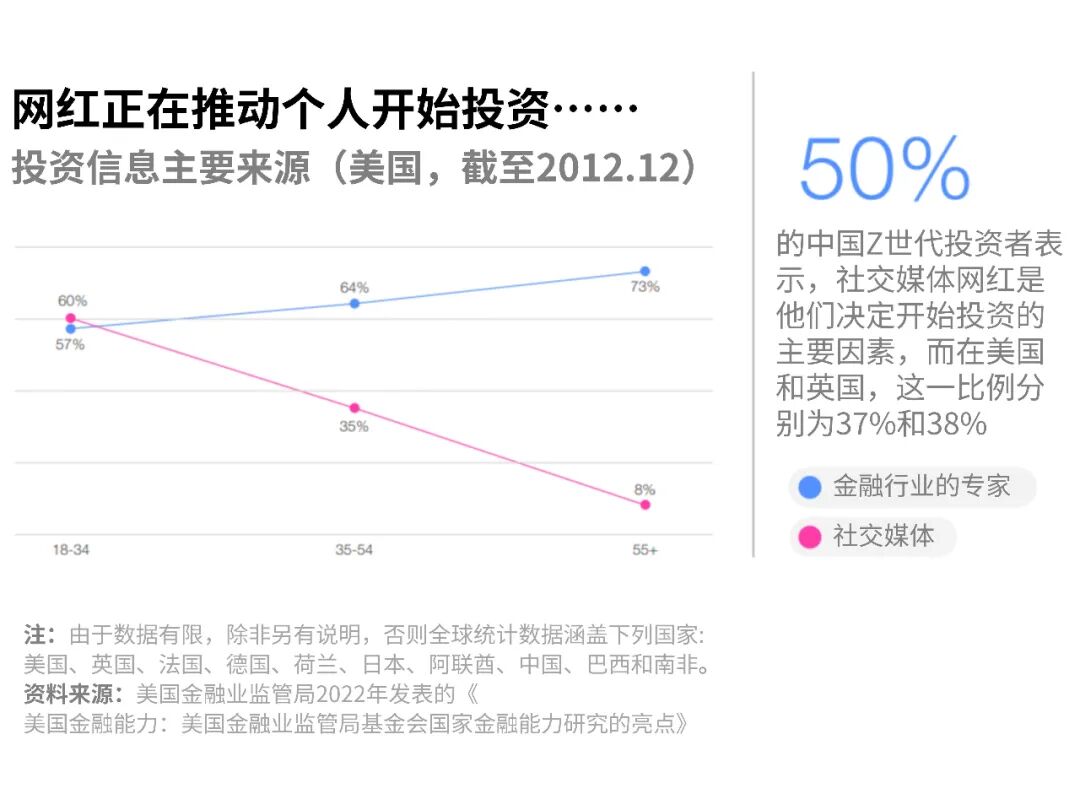

2. Overall financial health comes into focusWe need more than just isolated solutions—such as car insurance policies or pension plans—we also require guidance and education to achieve what the report calls "overall financial wellness." Financial wellness is when an individual feels confident in meeting both current and future financial obligations.The forum found that people are seeking one-stop services to provide comprehensive, unbiased advice for all their financial needs, as well as long-term planning support tailored around major life events.This holistic approach not only helps boost savings and investments but also carries significant psychological value. The report notes that U.S. research shows it can make people feel less vulnerable and alleviate concerns about their personal finances, ultimately having a profound impact on overall well-being and workplace productivity.Banks must seize this opportunity to deliver more targeted advice and education by leveraging technologies such as mobile apps and websites.3. Hyper-personalized service and 24/7 digital accessThis personalized approach is increasingly becoming the default expectation among people. According to the forum, more than three-quarters of Americans now view personalized interactions as the standard. Beyond tailored recommendations, they also want instant access to their accounts and financial products.Technologies like "robo-advisors"—digital platforms that offer automated, algorithm-driven financial planning and investment services—can help bridge this gap. They can assist us with everyday financial management while leaving major life decisions to human experts.4. Transparent and fair pricing lowers the barrier to entryChanges in consumer preferences, coupled with policymakers' efforts to create more flexible, transparent, and equitable pricing structures, have spurred innovation in financial institutions' business models.In the United States, nearly 90% of households prefer fee-based financial advice over commission-driven financial consulting. Over the past eight years, the share of revenue generated by financial advisors through fees has risen from just over half to 75%. Meanwhile, in Europe, commission-driven sales still account for a larger portion of the market. The forum noted that research shows more than two-thirds of European adults do not trust the financial advice they receive.Underneath these top-line figures, transparency is particularly favored by the two youngest generations—Gen Z and Millennials, who are more likely to switch advisors in order to cut costs.Therefore, banks must prioritize delivering financial advice and education—not only becoming more independent but also more cost-effective. The financial industry has the opportunity to integrate human, multi-channel, and automated advisory services into its business models, while also offering differentiated pricing tailored to various customer segments.5. Technological Innovation and Artificial IntelligenceAs customer expectations rise and new markets emerge, deploying technology is crucial for boosting productivity, reducing costs, and expanding market access.The interactivity of digital and mobile platforms can also enable greater personalization and help demystify financial planning.Generative AI will play a critical role in automating many routine processes, enabling advisors to dedicate more time to personalized consultations. At the same time, AI can streamline advisors' workflows by delivering actionable insights in real time and automatically generating tailored recommendations.Higher levels of digitalization and automation will also reduce the costs and barriers for young people or low-income families in accessing financial advice.However, only financial services companies committed to modernizing their technology stack will be able to meet these expectations.Financial influencers have won the favor of the younger generation by offering practical, easy-to-understand advice.

Image source:World Economic Forum, Accenture

6. The Birth of the "Financial Influencer Economy"Almost no industry can escape the influence of social media—financial services are no exception.The influencer economy has now become a $24 billion industry. According to the forum, while the top 10 global financial institutions collectively boast 10 million followers, the top 10 "financial influencers" have already amassed a staggering 64 million followers.Today, social media influencers play a crucial role in financial education and advice, filling gaps that the traditional financial industry has yet to address—especially among Generation Z and Millennials. Compared to banks, influencers are seen as more approachable and inclusive, rather than simply "pushing" products.Nevertheless, they are not always qualified financial advisors. As a result, their advice may lack consideration for risk management, and they might need to be more transparent about their affiliations as well as how they profit from their activities.Nevertheless, financial influencers are gaining an edge over traditional financial service providers by offering financial education and improving access to services in underserved communities. The financial advisory industry must continue to evolve its business models to bridge this gap—and regain trust by expanding its offerings to a broader investor base.The above content represents the author's personal views only.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Editor: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"