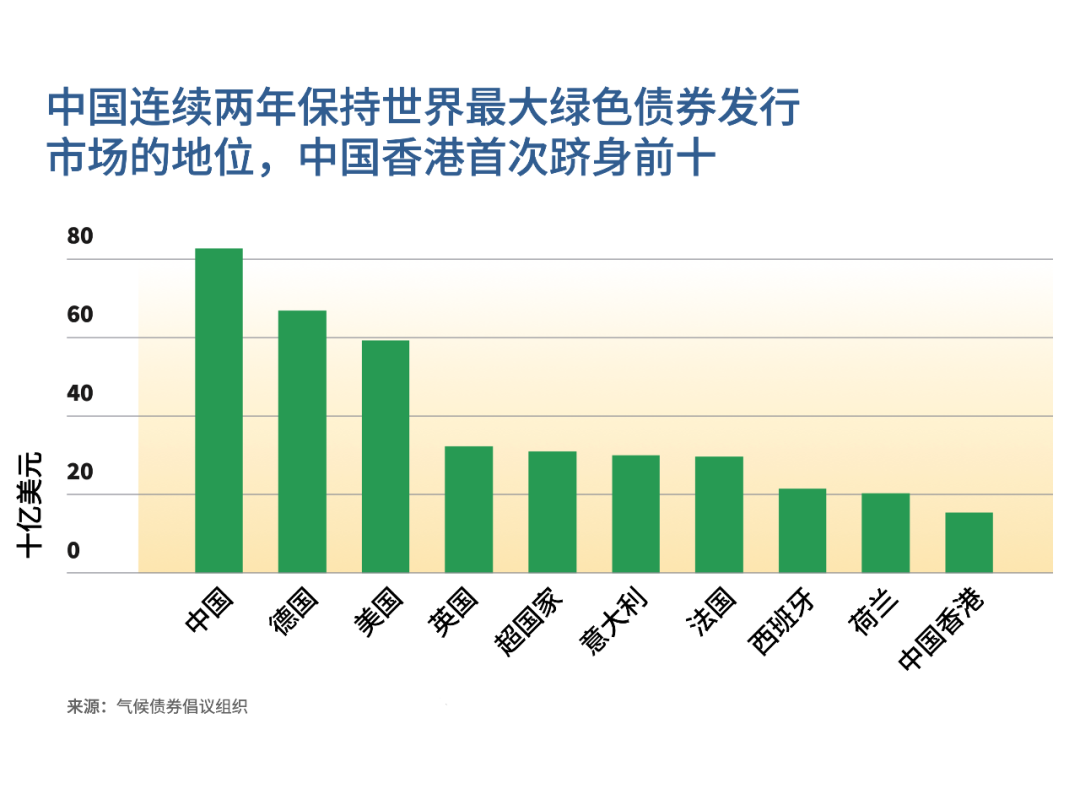

China has already become the world's largest green loan market.

Image source:Unsplash/Planet Volumes

Andrea Willige

Senior Contributor to the Forum

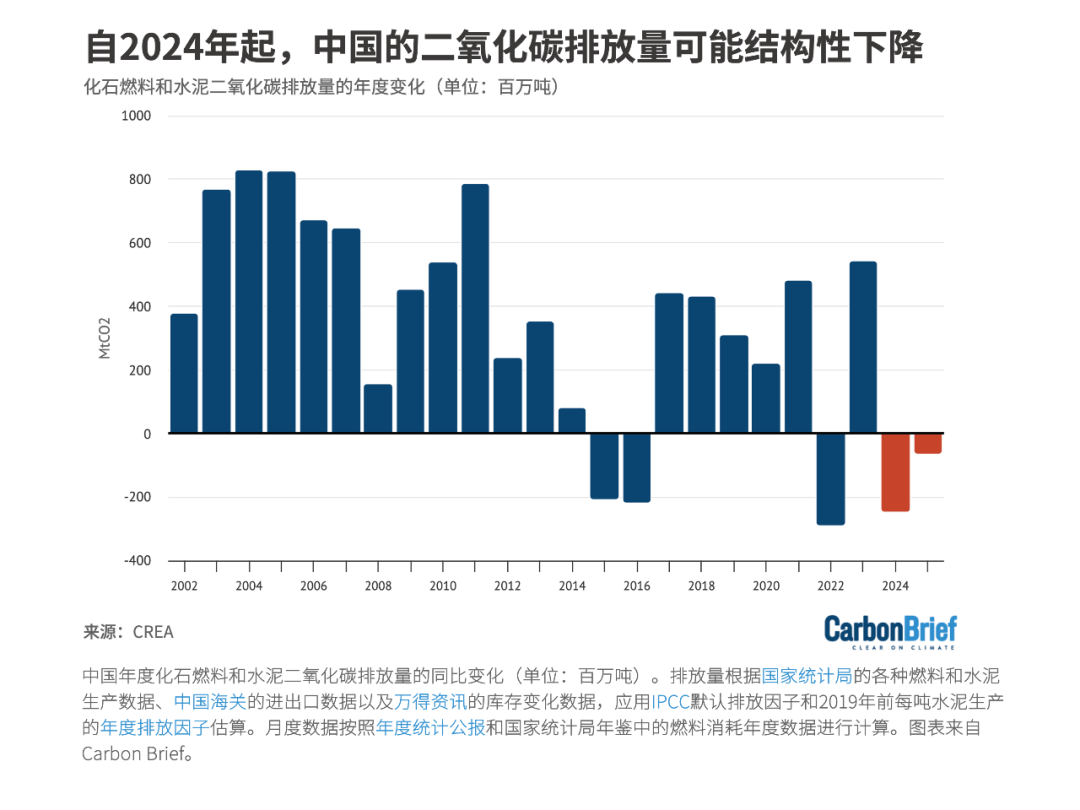

A new report predicts that China's carbon dioxide emissions will decline in 2024, marking the first drop since the pandemic began.

According to the UK climate policy website Carbon Brief, this decline was driven by record levels of low-carbon energy capacity, increased hydropower generation, and reduced emissions from power generation and heavy industry.

,

2022,Carbon Brief,2023,5%,

Image source:Carbon Brief

Image source:

Green Finance Reform and Innovation PilotWhat impact does the district have?China is implementing a series of “Green Finance Reform and Innovation Pilot Zone"Incentive measures."These pilot zones were established in the late 2010s to test various green finance approaches tailored to specific economic conditions. Many of the financing options rolled out in these regions have since served as valuable benchmarks for best practices, guiding the nation’s broader green finance initiatives.China began developing a green finance framework in 2016, laying the groundwork for its green growth in the electric vehicle, battery, and renewable energy sectors."China has become the world’s largest green loan market. Our green loans exceed 30 trillion RMB, equivalent to roughly $4.5 trillion. We’ve also developed the largest green bond market globally, with outstanding issuance reaching 2.5 trillion RMB."China has already recognized the environmental benefits of this approach."You can clearly see that, over the past 10 years, air pollution indices in cities like Beijing have dropped significantly. As far as I know, the average PM 2.5 level used to hover around 90, but now it’s approximately 30—representing an almost 70% reduction in air pollution."Dr. Ma Jun explained that China is shifting its focus from renewable energy and electric vehicles to transition finance, which will help industries struggling to cut emissions achieve decarbonization.The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your WeChat Moments; please leave a comment below if you'd like to republish.

Translated by: Di Chenjing | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"