China dominates the critical mineral refining sector.

Image source:Unsplash/Wanghao Sang

Surrounding joy

Professor at the Faculty of Law, University of New South Wales

Co-Director of the China International Business and Economic Law (CIBEL) Center

China dominates the refining sector for critical minerals but faces its own supply vulnerabilities, highlighting the complex web of global dependencies.

On the national strategy front, efforts are being made to implement robust industrial policies in key mineral sectors, while also emphasizing the promotion of international cooperation.

China's balanced approach to engaging with global frameworks can help reduce geopolitical tensions and foster sustainable supply chain solutions.

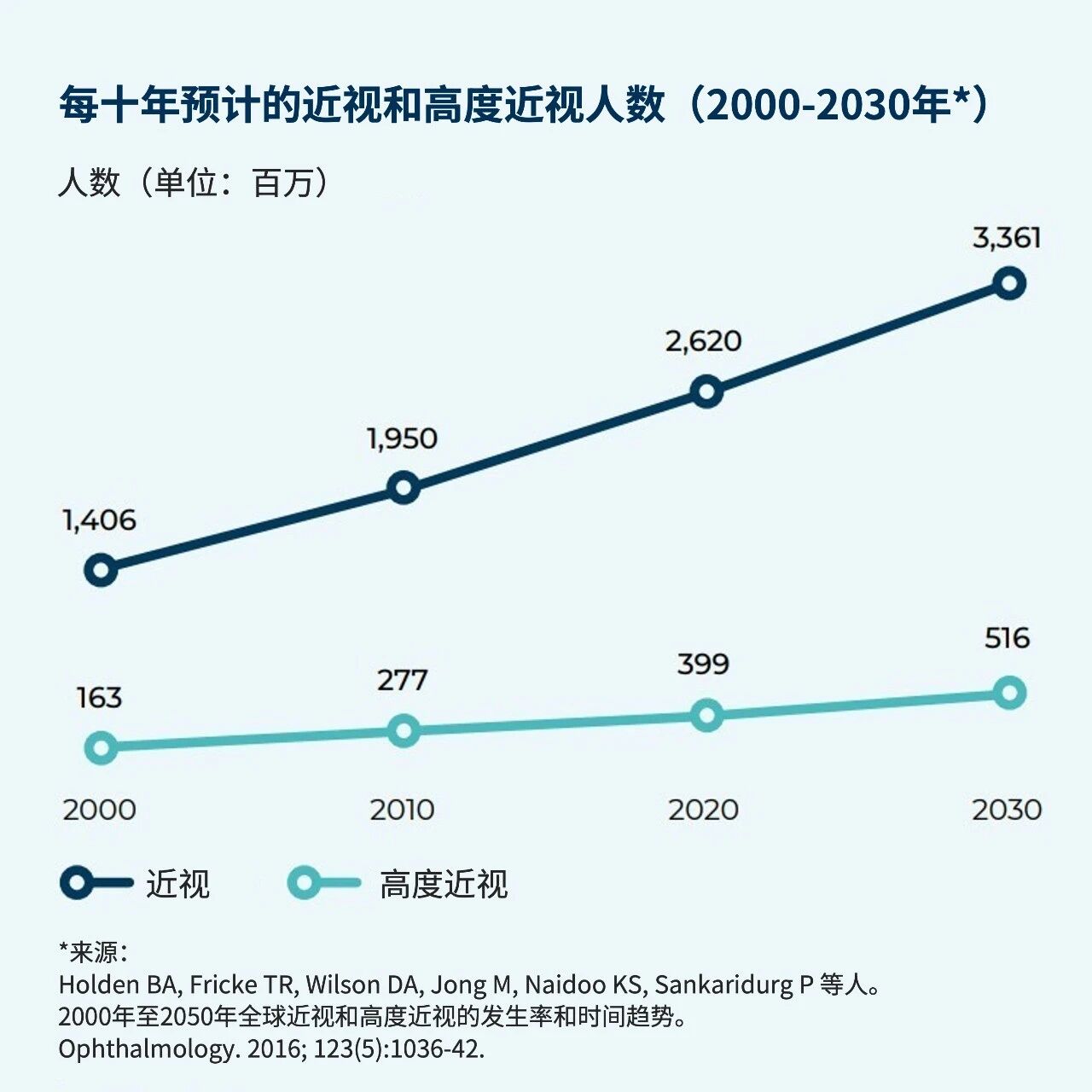

China's central role in the global supply chain, combined with the current tense geopolitical landscape, has already prompted major economies to begin implementing "de-risking" strategies toward China. However, the supply of critical minerals is increasingly becoming a cause for concern.However, when it comes to critical mineral supply chains, we shouldn’t view them through a one-sided geopolitical lens—but rather gain a more nuanced understanding of the multifaceted strategies surrounding these vital resources.Although China does not hold an absolute natural advantage in the global distribution of mineral resources, as the world’s largest importer of critical minerals, it dominates the refining stage and supplies its processed products to the rest of the world.The United States, India, and Germany are the largest importers after China; meanwhile, exports of raw materials, semi-finished goods, or processed critical minerals from the U.S., Chile, Switzerland, and Australia have also seen significant growth.China faces common challenges such as dependency issues, supply disruptions, and price volatility. As the world’s largest manufacturing hub and a major source of numerous green technologies, China is expected to continue grappling with shortages and supply challenges for many critical minerals.Global Critical Minerals StrategyGovernments around the world have introduced a variety of policy measures to ensure the supply of critical minerals. For instance, the EU has called for boosting domestic production and recycling of key minerals, as well as forging partnerships to enhance trade and investment in foreign critical mineral sectors.Similarly, the United States has also developed a multi-pronged strategy to strengthen its critical mineral supply chains and reduce reliance on China. The strategy includes reshoring supply chains among "trusted partners," forging bilateral agreements with allies, and building broader partnerships under the U.S.-led Minerals Security Partnership and the Indo-Pacific Economic Framework (IPEF).Meanwhile, resource-rich economies such as Indonesia, Chile, Mexico, and Zimbabwe have been leveraging export restrictions, resource nationalization, and other measures to boost the development of their domestic processing facilities. Perhaps the most notable example is Indonesia’s growing nickel refining and electric vehicle battery industries.While these measures are backed by legitimate concerns and strategic objectives, they largely focus on domestic industries and could potentially cause significant disruptions to critical mineral supply chains.An Overview of China's Strategies and PoliciesChina's critical minerals strategy originated in the rare earth industry during the 1970s, an industry that, while achieving unparalleled scale and efficiency, has also grappled with challenges such as illegal mining, overproduction, depletion of natural resources, and environmental pollution.Therefore, China has gradually developed a balanced approach, leveraging technology, innovation, and sustainable development to drive industrial reform while safeguarding natural resources and the environment.China’s "National Mineral Resources Plan (2016–2020)" identifies 24 "strategic minerals," including both metallic and non-metallic resources as well as energy commodities, while also outlining the country’s overarching strategy for the mineral resources sector—integrating both inward- and outward-oriented policies.Domestically, China is focusing on developing mining activities, enhancing the efficient use of mineral resources, and safeguarding and optimizing its industrial structure. At the same time, the country is driving innovation to promote a circular economy and foster "green development" in industry. Internationally, China is prioritizing the advancement of collaborative international partnerships in the mining sector with foreign countries.A comprehensive and impartial accountViewing China's critical mineral strategy solely from a geopolitical perspective can easily lead to misunderstandings and confrontation.The "de-risking" strategy envisioned in the 2023 G7 Hiroshima Summit Communiqué is a prime example. Although this concept is touted as more moderate than the radical idea of "decoupling," the two essentially share little distinction in terms of policy recommendations and real-world outcomes.However, China's strategic development of critical minerals highlights the need for a more comprehensive and balanced narrative. In other words, the key drivers behind these strategies have consistently been China's domestic economic needs and policy priorities.China's economic pressuresMore than a decade ago, there was a notable case involving critical minerals: during the China-Japan East China Sea dispute, China imposed restrictions on its rare-earth exports to Japan. Contrary to popular belief, empirical data reveal that these restrictions stemmed from China’s broader efforts to reduce rare-earth exports—rather than targeting any specific economy.Recently, China imposed export controls on germanium and gallium. While this move has also raised concerns about economic coercion, it is widely seen as a response to the U.S. restrictions on exporting advanced chips and other critical technologies to China. Amid this backdrop, both countries have taken coercive actions, citing national security as the underlying rationale.Moving forward through collaborationSince China remains a key player in the global economy, measures aimed at reforming critical mineral supply chains should not exclude the country.For instance, the IPEF supply chain agreement could yield better results by involving China in shaping cooperative mechanisms to address supply chain risks, opacity, non-market policies, and unnecessary trade restrictions.Alternatively, the same issues could also be discussed in inclusive forums such as the World Trade Organization.The mainstream narrative of viewing China as a risk due to geopolitical considerations could backfire if the goal is to minimize disruptions and uncertainties in global supply chains. A more balanced and comprehensive narrative, however, would be the first step toward fostering coherent, globally coordinated policy responses.

The above content solely represents the author's personal views.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Translated by: Sun Qian | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"