The chief economist’s early expectations of fragmentation and trade disruptions have evolved into forecasts of a prolonged structural transformation.

Image source:Reuters / Octavio Jones

John Letzing

Digital Editor, World Economic Forum

Philipp Grosskurth

Head of Insights on Economic Growth, Recovery, and Transformation at the World Economic Forum

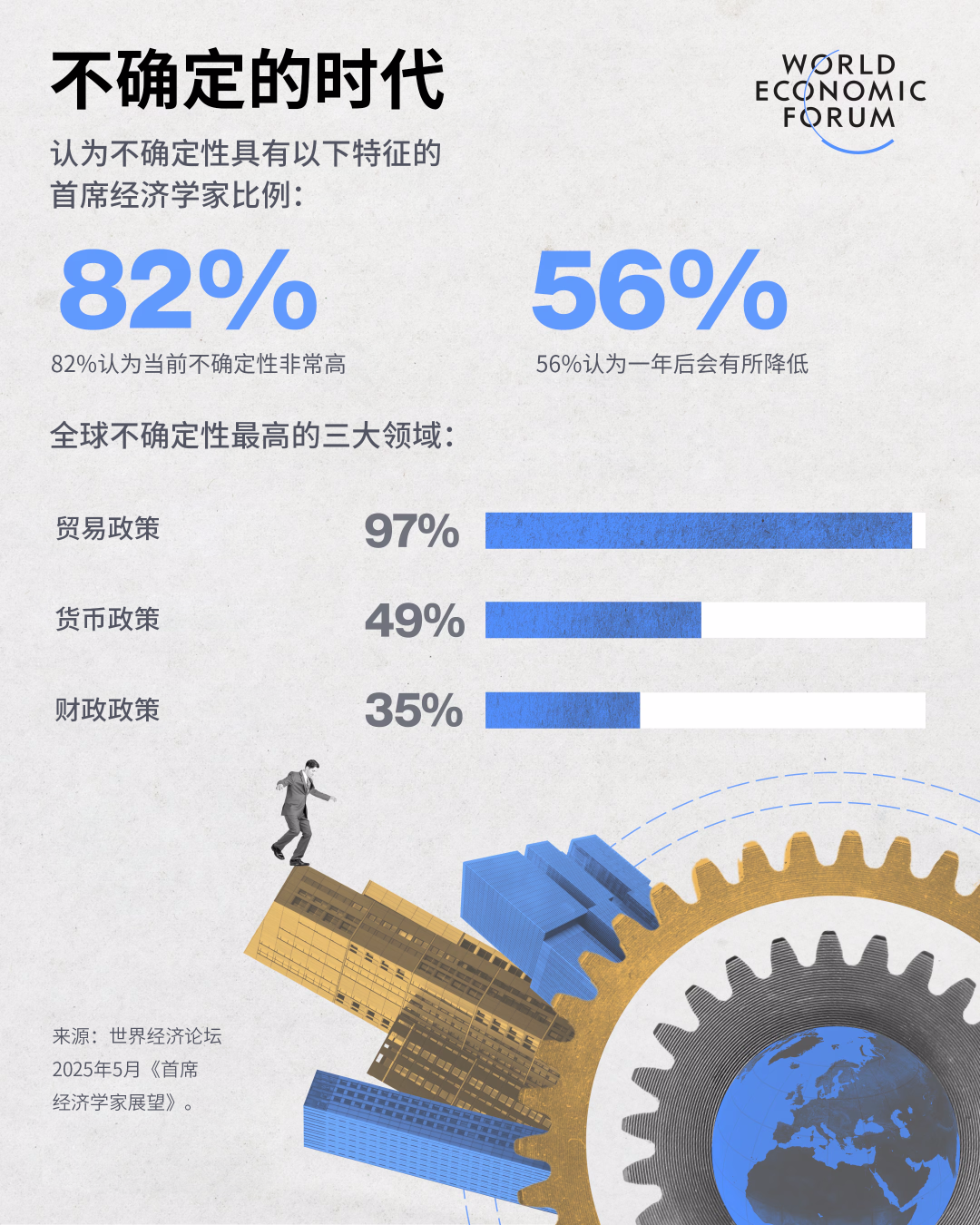

According to the World Economic Forum's recently released "Chief Economist Outlook," recent U.S. trade policy actions have further heightened expectations about a long-term transformation of the global economy.

Several chief economists provided detailed insights on this topic.

Despite heightened uncertainty and a generally pessimistic outlook, there are also signs that the future may bring a more stable situation.

It hasn’t been long since the World Economic Forum last released its regular outlook from chief economists on the state of global growth, yet in just a few months, perspectives have already shifted significantly.

Initial concerns about fragmentation and trade disruptions have evolved into predictions of a long-term transformation. In the forum’s latest "Chief Economist Outlook," 79% of respondents believe that recent, historic policy shifts in the U.S.—such as tariff policies—are part of a broader, enduring shift in the global economic landscape. This figure was slightly lower at 61% in the previous report released in January of this year. Meanwhile, only about one-fifth of respondents view these changes as merely short-term disruptions.

While the speed at which the announcement was released may differ from the level of alarm it triggered, uncertainty appears set to persist. The report also highlights ongoing expectations of slower growth and localized inflation, while delving into additional topics such as political polarization, a strengthening U.S. dollar, the expanding scale of defense budget financing, and the potential implications of artificial intelligence.

Some chief economists believe that uncertainty will ease up soon.

Image source: World Economic Forum

Nevertheless, there is still a glimmer of hope—we may soon identify a new benchmark, using it as a foundation to rebuild and move forward. The chief economist noted that business leaders will need greater strategic flexibility, while unemployment levels could drop to near historic lows.

Here are their detailed insights:

Paul Donovan, Chief Economist at UBS Global Wealth Management

"The dominant theme shaping the global economy today is uncertainty. U.S. policy decisions have become increasingly unpredictable. This uncertainty in policy details is compounded by the unpredictability across various economic sectors—and by the uncertainty surrounding how these sectors will ultimately respond to both the erratic nature of policy and its final outcomes."

"We had initially assumed that the original announcement of ‘shock’ trade tariffs would be swiftly withdrawn, and this prediction has largely held true. However, the probability of risk scenarios surrounding this core scenario remains high. The U.S. could face a self-inflicted slowdown in economic growth and rising inflation. In the absence of greater certainty, investment and hiring decisions are stagnating. That said, we do expect the U.S. to manage the second-round inflationary effects and concerns about job losses—combined with the strong start to this year’s economic growth, this should help avoid a more severe recession."

"In other regions, disruptions to global trade will clearly weigh on growth, but the worst-case scenario can still be avoided. Fiscal policy countermeasures will help, and tariffs have (so far) not yet escalated into multilateral measures. The decline in U.S. export volumes—while dampening economic growth—likely reflects the broader U.S. economic slowdown rather than a loss of market share due to tariffs. Meanwhile, the trend of moderating deflation outside the U.S. is expected to persist, further supporting consumers' purchasing power."

Karin Kimbrough, LinkedIn Chief Economist

"The global economic outlook continues to be weighed down by ongoing policy and trade uncertainties. "This collective uncertainty has already begun to impact the labor market, dampening employers' demand for workforce. Many businesses are hesitant to incur additional labor costs in such an unstable environment, which is reflected in a noticeable slowdown in hiring activities and a declining rate of filling open positions."

"Globally, hiring rates showed signs of stabilization earlier this year, but reversed again in March and April. In the U.S., hiring slowed by about 6% year-on-year in March and April. Australia saw a 10% decline, while Germany and France each experienced drops of roughly 20%. Meanwhile, the UK recorded a 9% decrease."

"This cautious sentiment is also reflected in job seekers' confidence levels. LinkedIn's U.S. Labor Market Confidence Index fell to a five-year low in March, and a similar decline in confidence is now spreading across Europe."

"Looking ahead, this 'soft' data may soon start to reflect in the 'hard' economic figures. While sectors like healthcare and energy continue to show some bright spots, signs of recovery that had previously emerged in areas such as technology, finance, and hospitality now appear to be stalling."

"However, if the current high level of uncertainty begins to ease, we remain optimistic that this period of weakness won’t last much longer. The post-pandemic hiring boom has clearly passed, but the labor market continues to demonstrate resilience—though unemployment hasn’t yet hit its historic low, it’s already hovering near that level."

Paul Gruenwald, Global Chief Economist at S&P Global Ratings

"In 2025, the global economy is starting on a solid footing, yet policy uncertainties are casting a shadow over its growth prospects. The main culprit is the U.S.'s erratic trade policies, which are weighing down global confidence and dampening expectations for economic expansion. The U.S. imposed hefty tariffs on April 2, only to later announce a temporary suspension of enforcement. A full-blown trade war between the U.S. and China initially erupted but was subsequently put on hold as well. Then, in late May, the U.S. announced it would impose steep tariffs on the European Union. As a result, America’s effective tariff rates have now reached their highest levels since the late 19th century."

"The market reaction to U.S. tariffs has clearly been negative. Valuations plunged sharply after the tariff announcement but have largely rebounded following the pause. Volatility, meanwhile, has spiked significantly. Trading remains generally orderly at present, though some markets—such as M&A and speculative-grade (relatively high-risk) debt issuance—are still closed."

"The impact of U.S. policy uncertainty on the real economy remains unclear. While soft data—such as the Purchasing Managers' Index, a regular survey of manufacturing market conditions—have shown weakness, hard data like industrial production and employment continue to remain robust. First-quarter GDP figures were distorted by the early implementation of tariffs. We expect growth to slow significantly, though in our baseline scenario, a recession is unlikely. Central banks around the world will likely remain cautious but should continue to ease policy gradually."

Beata Javorcik, Chief Economist at the European Bank for Reconstruction and Development

"The turbulence triggered by the shift in trade policy will ripple through nearly every country. The economic impact could be quite significant—ranging from the direct effects of tariffs on U.S. exports to the indirect consequences of weaker performance in other export markets, as well as fluctuations in commodity prices and their influence on inflation."

"Heightened uncertainty may continue to force governments to operate with limited visibility, while also encouraging investors to adopt a 'wait-and-see' approach. "Multinational companies are likely to shift their focus—from ensuring the resilience of global value chains in terms of supply security—to prioritizing market access as the key issue."

Gregory Daco, EY Chief Economist

"The U.S. government's erratic tariff stance has triggered a global confidence crisis: the U.S. consumer confidence index has plummeted to its lowest level since the 1980s, while global business outlook expectations have also fallen to multi-year lows. Although private spending hasn’t yet shown significant contraction—thanks to pre-emptive consumption ahead of tariff changes—financial volatility and weakening demand for dollar-denominated assets are increasingly posing serious risks to the global economic outlook."

"Global real GDP growth is expected to slow from 3.2% in 2024 to 2.8% in both 2025 and 2026—marking the weakest pace of expansion since the pandemic and, even earlier, following the 2009 financial crisis. Although the U.S. and China mutually reduced tariffs in May, the average U.S. tariff rate remains at a historically high 14%, continuing to weigh heavily on global trade and economic activity."

"Developed economies are expected to grow by just 1.2%, with the U.S. GDP projected to expand by 1.3% and the Eurozone nearing 1% growth. China’s mainland economy is forecast to see its growth rate slow from 5% in 2024 to 4.3% in 2025, while India remains resilient, maintaining a growth rate of around 6.4%. Against the backdrop of persistently high inflation and slowing economic activity, central banks across these countries will cautiously recalibrate their policies."

"The global economic outlook is overshadowed by protectionism, fiscal pressures, and ongoing geopolitical uncertainty—underscoring the need for business leaders to demonstrate greater strategic flexibility."

Ludovic Subran, Chief Investment Officer at Allianz

"The 2025 Global Economic Outlook reveals a significant slowdown in growth, marking the weakest expansion level since 2008—excluding the pandemic era. The downward revision of growth forecasts is primarily driven by ongoing policy disruptions in the United States. However, the recent U.S.-China trade truce offers a glimmer of hope: the U.S. has halved its effective import tariffs on goods from China, and the strategic approach toward reaching an agreement could help ease the current situation further before the end of the year. Still, given the unpredictable nature of trade policies, volatility and uncertainty remain persistently high."

"Global inflation is expected to decline from 5.4% in 2024 to 4.2% in 2025, with U.S. inflation peaking at 3.5% by the end of summer. This will prompt the Federal Reserve (the U.S. central bank) to cautiously ease policy—reducing rates to 4%—before year-end, while the European Central Bank (ECB) is likely to cut interest rates below 2%. Meanwhile, global trade is projected to experience a downturn in merchandise trade volume, falling by 0.5% in 2025. China, meanwhile, plans to boost its economy through targeted fiscal stimulus measures, with the scale of these initiatives expected to reach 2.6% of GDP—1 percentage point lower than pre-tariff suspension levels. Thanks to diversified exports and a moderately devalued currency, China’s GDP growth is forecasted at 4.5% in 2025. In contrast, the Eurozone is likely to face growth below its potential due to trade disruptions; however, supported by Germany’s stimulus package and increased defense spending, investment and consumer demand should provide some much-needed uplift."

The above content represents the author's personal views only.This article is translated from the World Economic Forum's Agenda blog; the Chinese version is for reference purposes only.Feel free to share this in your Moments; for reprints, please leave a comment at the end of the post or message us via our official.

Translated by: Sun Qian | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Accounts, Douyin, and Xiaohongshu!

"World Economic Forum"