China is emerging as a key player in the sustainable aviation fuels sector.

Image source:Unsplash/Deniz Altindas

Giorgio Parolini

Head of Aviation Decarbonization at the World Economic Forum

He Yiran

Head of Industrial Decarbonization, Greater China, World Economic Forum

Thanks to its abundant raw materials, relatively low costs, and the rapidly expanding renewable energy industry, China is emerging as a key player in the sustainable aviation fuel (SAF) sector.

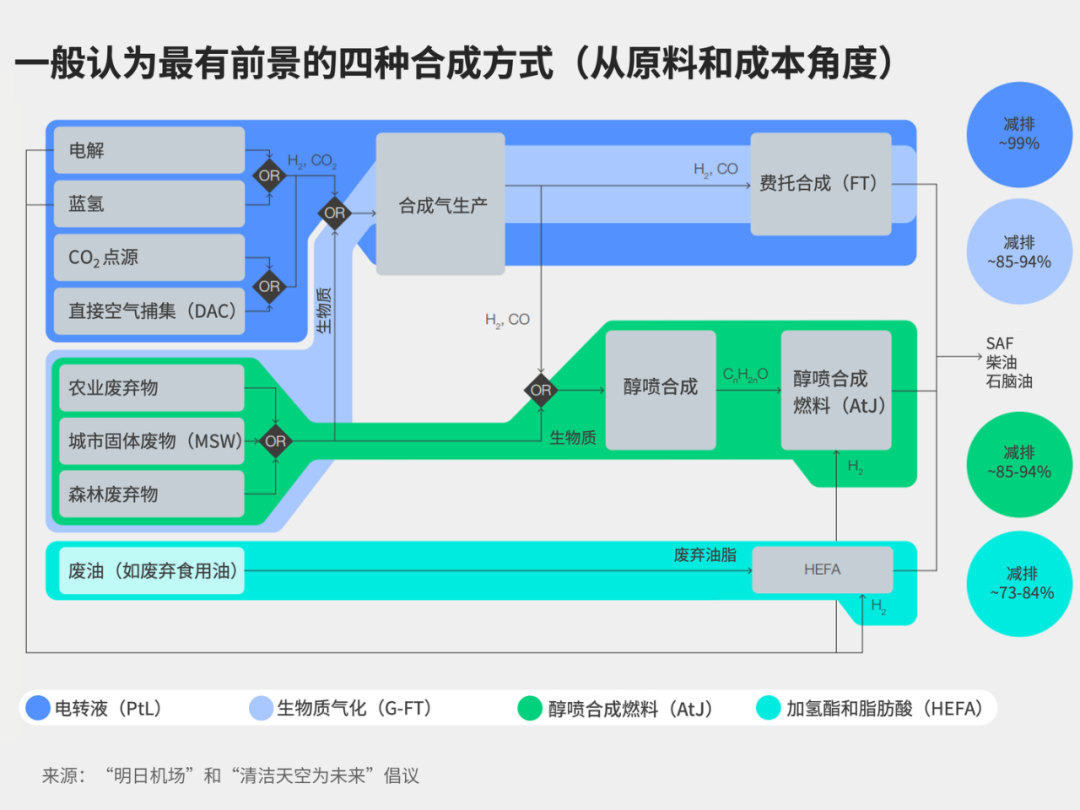

While China currently relies primarily on waste cooking oil from the food industry to produce SAF, constrained by raw material supply, the country must explore alternative pathways such as alcohol-to-jet synthetic fuels and electrofuels to meet future challenges.

China's rapid advancement in the sustainable aviation fuels sector, along with its sustainability standards, could significantly impact the global market and potentially spark trade tensions with major economies like the EU and the U.S.

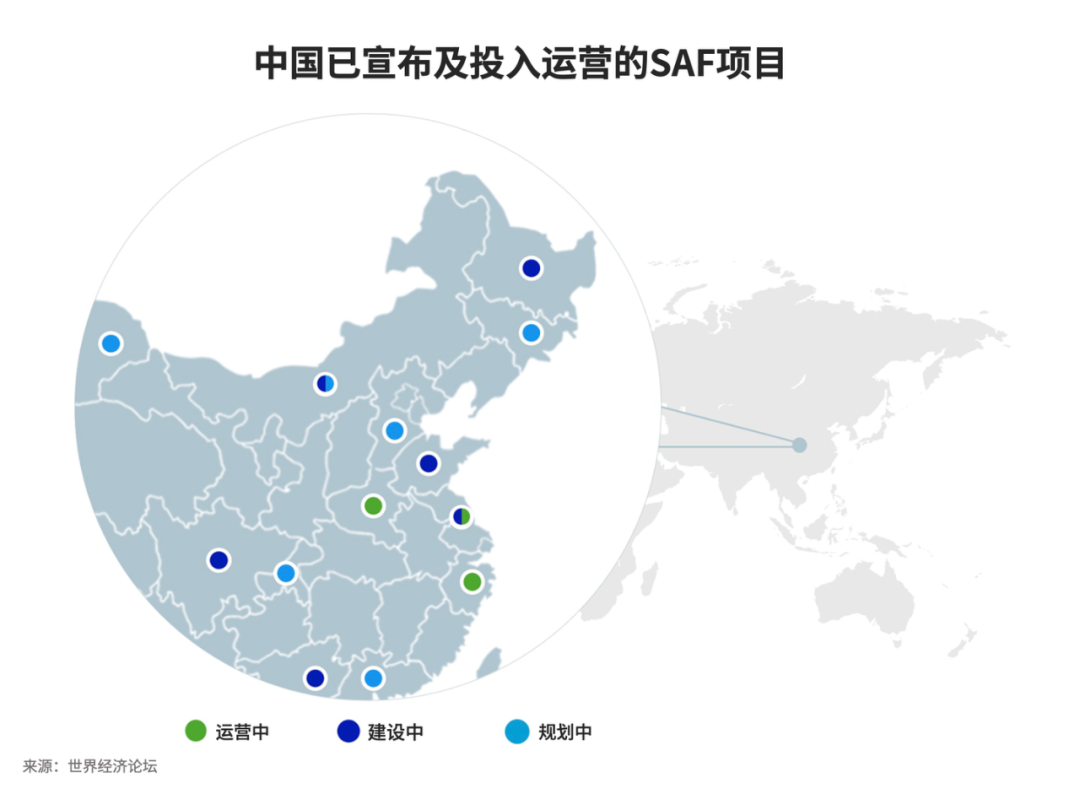

Thanks to its relatively low costs, abundant raw materials, and the world's fastest-growing aviation market, China is emerging as a key player in the sustainable aviation fuels (SAF) sector.China is a major exporter of waste oil feedstocks—such as used cooking oil—which can be repurposed to produce SAF. SAF, a type of jet fuel, can reduce lifecycle carbon emissions by up to 80% compared to conventional fossil fuels. By prioritizing the development of domestic SAF production, China can rapidly expand its SAF refineries and accelerate its journey toward decarbonizing the aviation sector. Additionally, China’s growing renewable energy projects—and the associated surplus electricity that currently goes unused—are paving the way for green hydrogen and its derivative, synthetic fuel (eSAF).By 2043, China is expected to become the world's largest aviation market, and SAF is the key to making this vision a reality.Other regions and countries, such as Europe and the United States, are also making efforts to develop SAF. However, Europe faces challenges in scaling up production due to global competition, high labor costs, and limited feedstock availability. Although SAF refineries are currently under construction, several projects have been shelved amid weak demand, technological uncertainties, and financial concerns.Europe's fuel supply market has long relied on imports. If Europe struggles to meet its SAF demand internally, could China help fill the gap—or will the fuel produced in China be reserved for domestic use?The World Economic Forum’s "Airports of Tomorrow" initiative recently hosted a key regional dialogue on the topics mentioned above.China's industrial layout in the SAF sectorAccording to the 14th Five-Year Plan (2021-2025), China's civil aviation industry aims to achieve a cumulative consumption of 50,000 tons of SAF by 2025.Currently, the country has already established an annual production capacity of approximately 400,000 tons, over 90% of which is dedicated to exports. Meanwhile, plans are underway to add an additional 3.9 million tons of capacity each year.China has announced and put into operation SAF projects.

Image source:World Economic Forum

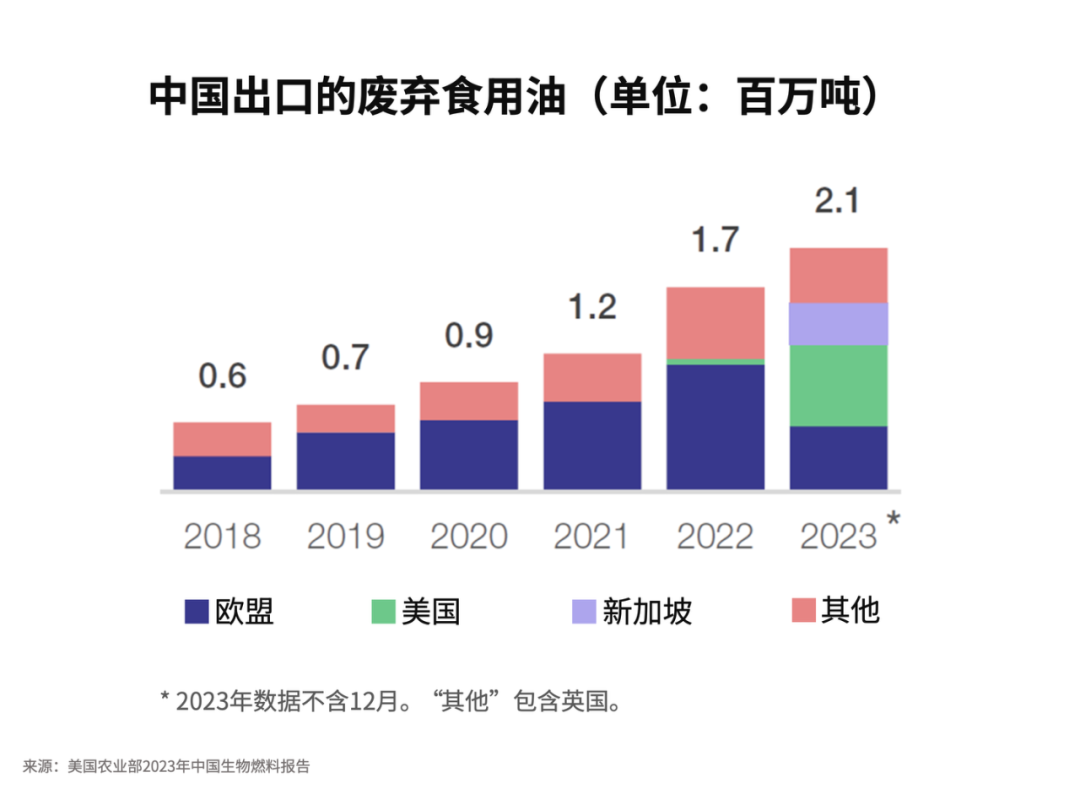

Starting with used cooking oilChina is boosting its SAF production capacity primarily by relying on the supply of feedstock and prioritizing its use, especially waste cooking oil from kitchens. This waste cooking oil can be converted into SAF via the hydrotreated esters and fatty acids (HEFA) process. The HEFA route transforms vegetable oils, waste cooking oil, or fats into aviation fuel and currently remains the mainstream approach.Currently, China exports significant amounts of used cooking oil, with major buyers including the Netherlands, Spain, Italy, and the United Kingdom—plus the United States, which joined the market in 2022 following the incentives introduced by the Inflation Reduction Act.China's exports of waste edible oil (in million tons).

Image source:U.S. Department of Agriculture 2023 China Biofuels Report

Enhancing the capacity to recycle waste cooking oil can boost local production and exports. However, by 2030, per capita consumption is expected to reach its peak, which will push the supply of waste cooking oil feedstock to its upper limit.Looking for alternative raw materials beyond used cooking oilDue to the long-term limited supply of used cooking oil, China must invest in alternative SAF production technology pathways.One option is to produce synthetic fuels via alcohol-to-jet technology, a process that utilizes feedstocks such as sugarcane, corn, and switchgrass. However, since the early 21st century, China has adhered to a food security strategy of "not competing with food crops for arable land," ensuring that fuel production materials—and other non-food uses—do not encroach on land traditionally reserved for grain cultivation. This approach aligns with China’s broader goal of reducing its reliance on foreign food imports and bolstering agricultural self-sufficiency.Considering this "red line," the issue of raw material supply could potentially limit the long-term, large-scale production potential of alcohol-to-jet synthetic fuel (SAF) technology. However, it is expected that China can still explore the use of bio-based waste materials to produce alcohol-to-jet SAF in the near term.Electric-to-Liquid TechnologyElectrofuels produced from renewable electricity, water, and carbon dioxide could become a long-term, viable alternative for China’s SAF development. Although currently this is the most expensive method of SAF production, it offers significant advantages in reducing carbon emissions and enabling large-scale manufacturing.The four synthesis methods generally considered the most promising, based on feedstock and cost considerations.

Image source:"Tomorrow's Airport" and "Clean Skies for the Future" Initiatives

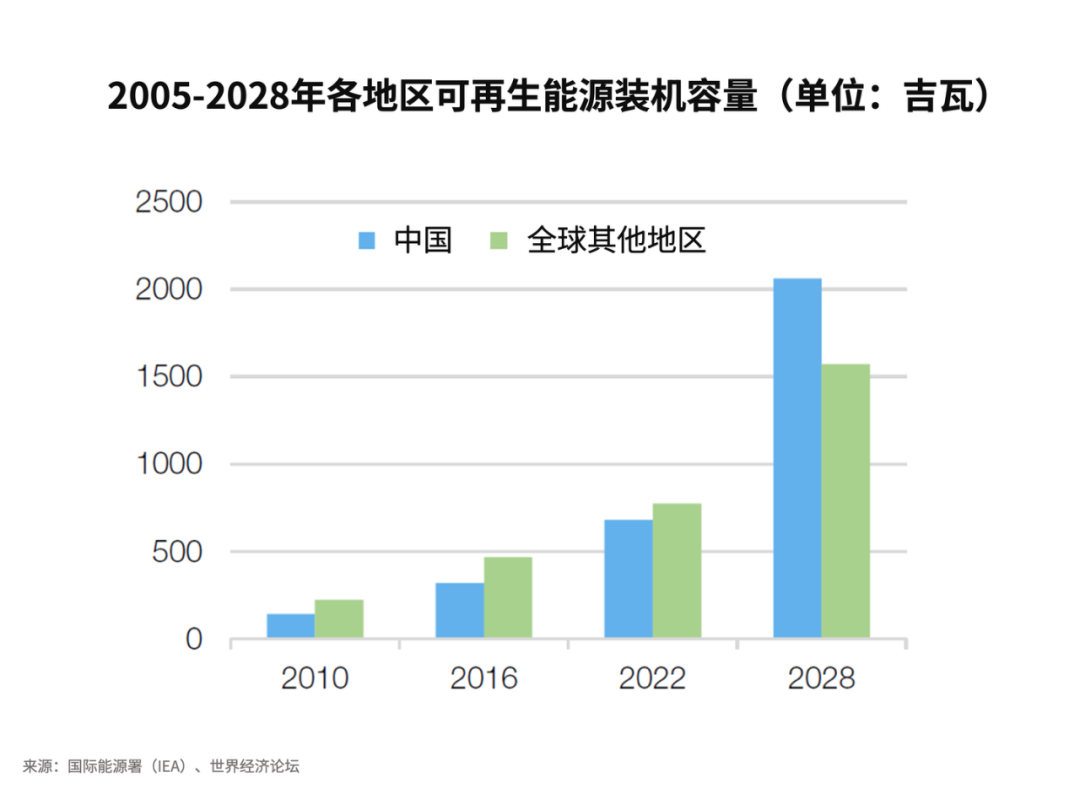

As the costs of solar and wind power generation continue to decline, China is poised to gain a competitive edge in the production of synthetic fuels.According to the International Energy Agency (IEA), by 2028, China is expected to account for nearly two-thirds of the world's installed renewable energy capacity, and by 2030, solar and wind power in China will generate nearly half of the country's electricity.However, the issue of "curtailed wind and solar power"—where excess clean energy is wasted due to grid limitations—remains a significant challenge. To address this problem, China can fully leverage this abandoned electricity to dramatically boost SAF production capacity.In 2023, China's wasted renewable energy reached as high as 35 terawatt-hours. According to the World Economic Forum's "Clean Skies for the Future" initiative,(Clean Skies for Tomorrow)The initiative offers a conversion ratio that, if all this electricity were used to produce e-fuel, would result in a production volume nearly 20 times China’s 2025 SAF consumption target.China's "Three-North" region boasts the greatest potential for green hydrogen and SAF production, yet these areas are not traditional aviation hubs. Therefore, to facilitate the wider adoption of SAF, it is essential to explore the development of physical infrastructure that enables efficient fuel transportation to end-use locations, alongside establishing a robust "SAF certificate trading" system.The SAF project and China's largest aviation hub.

Image source:The passenger throughput data for Hong Kong and Macao International Airports, featured in the World Economic Forum/Civil Aviation Administration of China's "2023 National Civil Transport Airport Production Statistical Bulletin," comes from publicly available sources.

Of course, to scale up the production of electro-to-liquid pathways, it will also be necessary to reduce the costs of electrolyzers and direct air capture technologies. Additionally, given that other industries are equally in need of green electricity, governments must also consider prioritizing decarbonization efforts across various sectors.Renewable energy installed capacity by region from 2005 to 2028 (unit: gigawatts).

Image source:International Energy Agency (IEA), World Economic Forum

Incentive Measures and Their Geopolitical ImplicationsIn mature SAF markets, regulators are driving industry growth by implementing mandatory blending mandates. For instance, the EU has set targets for gradually increasing the share of SAF in aviation fuel—starting at 2% in 2025 and progressively rising to 70% by 2050.In contrast, China's SAF policy is still in the process of being formulated. Stakeholders in the aviation industry believe that mandatory blending mandates will only be introduced once it’s ensured demand can be met.All parties at the meeting organized by us unanimously agreed that supply-side measures and targeted policies could also boost confidence among the industry and investors—for instance, by introducing land-leasing incentives or considering integrating SAF into the national Certified Voluntary Emission Reduction program.While government incentives can drive economies of scale and reduce costs, they may also attract international scrutiny. In the U.S., there have already been calls to impose additional tariffs on Chinese products—such as used cooking oil—though these calls gained further momentum after the presidential election. Meanwhile, the EU confirmed in July that it would introduce new tariffs on biofuels sourced from outside the bloc.Some analysts suggest that if Europe perceives China’s incentives as threatening its own competitiveness, similar trade measures could also extend to the SAF sector. Timing is critical in these trade actions: acting too soon might cause Europe to miss out on the benefits of China’s advancements in the SAF space, while moving too late could leave European industries increasingly vulnerable to declining competitiveness—much like what has already happened in the electric vehicle market.Ensuring sustainability is key.China's ability to export SAF to the EU and other markets also depends on the sustainability of its fuels and feedstocks. Europe has implemented stringent sustainability standards to prevent potential negative impacts—such as land-use concerns—from the widespread adoption of low-carbon fuels.In light of this, China's Civil Aviation Administration established the China Sustainable Aviation Fuel Development Research Center in Chengdu, Sichuan Province, in July 2024. As China's first official specialized technical institution dedicated to sustainable aviation fuel, the center has already launched a public consultation on three domestic standards—covering the HEFA pathway for SAF as well as the carbon assessment of SAF throughout its lifecycle. This initiative aims to lay a solid industry foundation and align China's SAF standards with global market practices.Launching a new chapter through pilot projectsThanks to technological advancements, robust raw-material supplies, and supportive policies, China is well-positioned to reshape the global SAF market. The country acted swiftly, launching its first-ever SAF pilot project in September 2024.China National Airlines, China Eastern Airlines, and China Southern Airlines will fuel 12 commercial flights with SAF at four airports, with plans to further expand the pilot program in 2025.The industry is eager to see how these early developments will shape China’s medium- and long-term SAF roadmap. This roadmap not only provides guidance for the domestic industry but will also have a profound impact on European and other global markets.This article was originally published in the China Daily.

The above content solely represents the author's personal views.Feel free to share this on WeChat Moments; please leave a comment below the post if you’d like to republish.

Translated by: Di Chenjing | Edited by: Wang Can

The World Economic Forum is an independent and neutral platform dedicated to bringing together diverse perspectives to discuss critical global, regional, and industry-specific issues.

Follow us on Weibo, WeChat Video Channels, Douyin, and Xiaohongshu!

"World Economic Forum"